Category: Technology

Delivering a Powerful Solution to Help New Zealand Customers Manage Their Finances

The current state of play In the midst of a cost-of-living crisis and with rising [...]

What is Open Banking?

Open Banking involves the secure sharing of financial data and services with third parties through [...]

What is Financial Wellbeing?

According to the Consumer Financial Protection Bureau, financial wellbeing is defined as “a state of being [...]

A Personalised Approach to Driving Customer Acquisition and Activation in Digital Banking

Personalisation has and continues to be a key area of focus for the banking sector [...]

Top Banking Trends 2024

As we approach 2024, digital banking is set for substantial changes, influenced by emerging trends [...]

Unlocking Profitability with Customer Activation Management

The current state of play In today’s competitive banking landscape, there is an imperative for [...]

A Guide to Successful Referral Programs in Banking

The value of incentivised referrals With many financial institutions vying for market share, the pressure [...]

Balancing Security and Seamless Experiences

Introduction In an era where digital transactions and online banking have become the norm, financial [...]

Enhancing Financial Wellbeing: The Role of Australian Mutuals

The Role of Australian Mutuals in the Financial Ecosystem The role of mutual banks (mutuals), [...]

How to Enhance Digital Banking Experiences to Boost Deposits

In today’s competitive world of banking, financial institutions such as banks, credit unions and large [...]

Why Marketing Automation Alone Falls Short for Financial Institutions

Marketing automation can undoubtedly be a powerful tool for enhancing customer engagement and streamlining marketing [...]

The Power of Gift Cards: Driving Engagement in Digital Banking

In the ever-evolving landscape of digital banking, customer engagement has become a top priority for [...]

Digital Banking and PFM in Africa

The Current State of Play in African Banking African consumers are swiftly embracing and adopting [...]

Mental Accounting Bias | Bitesize Behavioural Science

Does money always mean the same thing to us? Or do we respond differently to [...]

The Role of Data Categorisation in Digital Banking

One of the biggest challenges facing banks today is how to effectively analyse and use [...]

Financial Wellbeing in a Cost-Of-Living Crisis

The cost-of-living has continued to increase in many parts of the world. Factors such as [...]

Minimising Technical Debt

At Moneythor, we are committed to delivering a technical solution that can be implemented with [...]

A new era of digital banking: How banks are turning what their customers want into a business advantage

Introduction Traditionally, fintech and banking product marketing teams are constantly ideating to come up with [...]

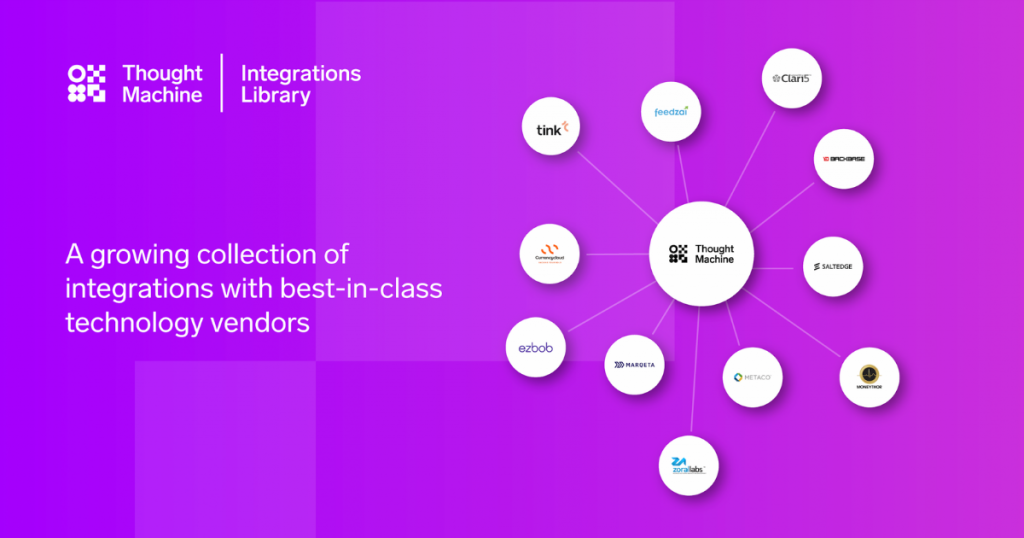

Integrating Moneythor to Thought Machine’s Vault Core

Thought Machine, the modern core banking technology company, launches their Integration Library today, and we [...]

Customer-centricity in retail banking: Personalization

Digital banks have been hailed as forerunners within an era of rapid technological advances, propelling [...]