Deep Banking

Made Possible by Moneythor AI

Your data is already there. We bring the logic and AI to put it to work, powering the personalised experiences and proactive engagement that define Deep Banking.

81%

Satisfied Users

7x

Sales Conversions

-22%

Reduced Customer Support

OUR CLIENTS

DEEP BANKING

Individualised insights, actions, and content tailored to each customer.

AI-powered experiences that anticipate needs and act in real time.

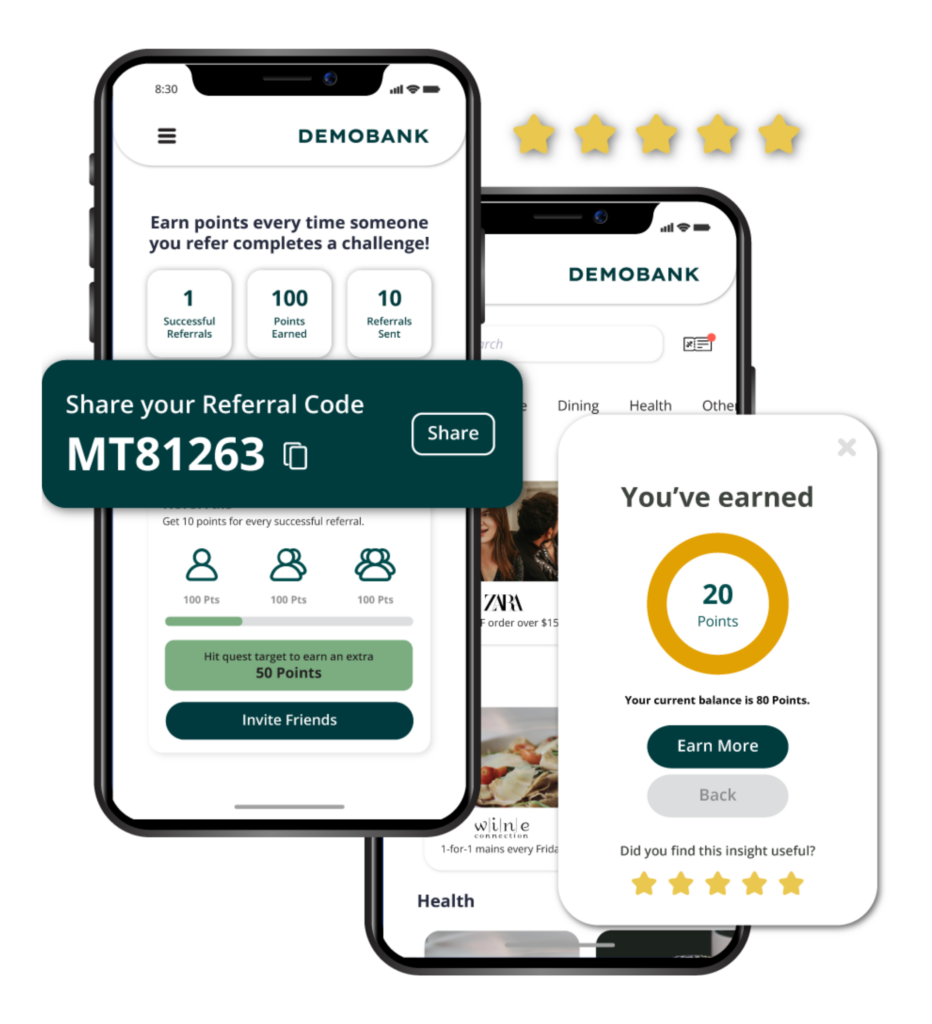

Supporting lifestyle goals with features like rewards, referrals, and gamification.

OUR PLATFORM

With over 115 use cases, from spend categorisation to rewarding savings goals, Moneythor has the tools to help you boost customer engagement.

Going beyond banking means integrating lifestyle elements into the banking experience. And it’s not just about cashback and miles, it includes concerts, challenge points, and even NFTs.

EXPLOREMADE POSSIBLE BY AI

Moneythor’s AI engine has used advanced algorithms and machine learning since our inception to deliver data enrichment and smart cash flow forecasting, proactive engagement and contextual recommendations.

Moneythor’s Code Sidekick which can be prompted by business analysts to create the advanced logic banks need to deliver personalised experiences, and Content Sidekick which helps to deliver another level of personalisation in messaging.

Delivers intelligent, real-time customer and/or bank staff interactions through in-app conversational assistants, guiding users with personalised advice, financial insights, and more.

Moneythor brings agentic AI into the hands of bank staff by surfacing intelligent, adaptive customer journeys and conversation starters for your Relationship Managers. These journeys are dynamically powered by LLM-based decisioning and real-time data, enabling staff to guide customers with greater personalisation and precision. While the system optimises and evolves autonomously in the background, human advisors remain in control.

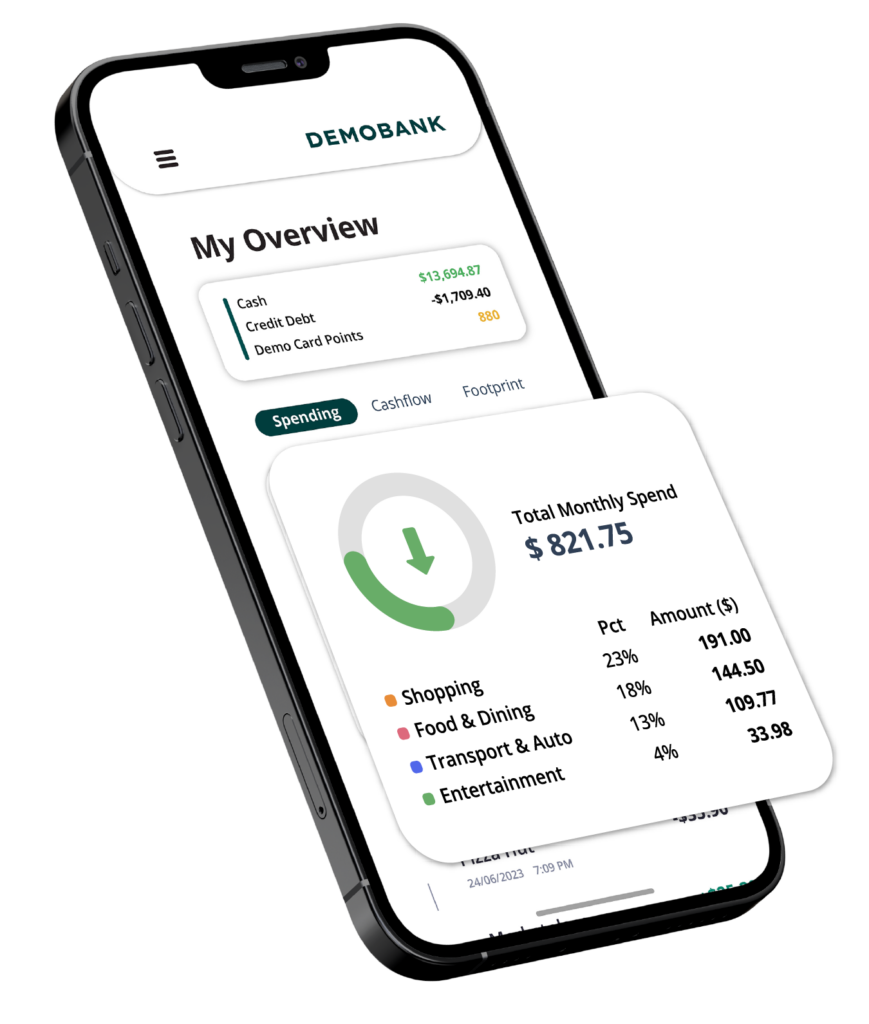

Make customer’s financial lives easier and drive real engagement with modern Personal Financial Management (PFM) features.

Provide captivating interactions to clients, aid them in improving their financial well-being while simultaneously boosting retention and loyalty. PFM use cases natively offered by the Moneythor solution include advanced transaction categorisation and enrichment techniques, spending budgets, savings goals, predictive cashflow analysis, as well as the production of tailored contextual insights.

Learn moreLet Moneythor handle the plumbing (orchestration, AI, infrastructure) while your teams build differentiated experiences, tailored to your customers and strategy.

With fast integration and AI capabilities, you can launch new personalised experiences, quicker than ever.

Unlike general-purpose personalisation platforms, our AI capabilities are built specifically for the needs, logic, and data models of financial institutions.

Our AI interacts, predicts, suggests, and acts on behalf of the bank or individual customers throughout their journeys to deliver deep banking experiences.

Rapidly plug into a variety of Generative AI platforms and fine-tuned Large Language Models with minimal friction and in a secure and compliant manner.

Moneythor was founded 10 years ago. We know what works and what doesn’t.

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields