What are PFM Solutions

PFM stands for Personal Financial Management and refers to the digital tools that people use to manage their financial lives. The purpose of PFM solutions is to simplify money management and help people make better financial decisions.

At its most basic, PFM solutions provide simple money management tools such as transaction analysis and categorisation. However, advanced PFM solutions can offer much more and can include a full suite of personalised insights, recommendations and nudges to help their users improve their finances.

Using AI and machine learning, banks can empower customers to make smart financial decisions with advanced PFM tools and insights that help them to track their spending, gain an overview of their finances and plan for the future.

Customers are expecting more from their banks and PFM solutions provide the level of personalised and actionable support that they are looking for.

Evolution of PFM Solutions

Cast your mind back to a time before computers, smartphones and the internet and think about how people used to track their income and expenses using a pen and paper or by doing calculations in their head. Personal financial management has come a long way since then.

Initially, it was the launch of personal computers that moved PFM tools forward with brands like Intuit and Microsoft launching PFM-style software that simplified managing household finances. While this was useful, it required a lot of manual data entry and took time to use.

As more banking services moved online, so did various PFM tools. Standalone consumer websites and apps, separate from banking channels, emerged and scraped data from banks to provide customers with a degree of personalised PFM. Even with these digital solutions, the experience was still fairly passive and at times broken.

PFM should be a simple process, but by making users go to an app that is separate from their main transactional channel, it added an unfortunate extra step.It soon became clear that the future of delivering effective PFM solutions involved offering PFM tools and insights within the account / card holding institution’s digital channel. This makes the PFM journey seamless and removes any friction points like moving to a separate app.

Technology providers emerged to deliver white-label PFM solutions to banks that they could use to provide personalised experiences at scale. Modern PFM solutions like Moneythor’s are powered by intelligent algorithms and data analytics to deliver predictive and personalised insights, recommendations and nudges in real-time. Advice is data-driven, proactive and actionable, and customers can focus not only on managing day-to-day expenses but also planning for the future and saving.

PFM Features

By providing smarter money management insights, tools and features, customers gain financial control and are empowered to make smart financial decisions. There are a number of PFM features that can be provided to customers at various stages of the customer journey to help them mange their finances better. PFM features can be grouped into 4 categories which include:

- Tracking

- Managing

- Planning

- Growing

Tracking

Too much data can be hard for the mind to process, especially if the data is unorganised and unclear. The first step in helping customers to make smart money management decisions is to provide them with clear and uncomplicated information about their financial standing.

Using AI and machine learning, advanced PFM solutions can analyse and categorise transaction data from multiple sources and banks in batch and some like Moneythor’s in real-time too. This data can then be used to deliver user-friendly graphs, feeds or widgets that provide customers with a clear and detailed overview of their spending by various dimensions such as category, merchant, biller, dates, amounts, etc. From here, customers are better equipped in their journey to manage, plan and grow their finances effectively.

“Tracking” PFM features may include:

- Manual Categorisation – For those transactions that don’t simply fit within a category, some solutions allow users to create their own custom categories and add transactions accordingly.

- Transaction Search – Tracking spending is made easier by providing users with an advanced including free text search functionality to pull up transactions based on any criteria.

Managing

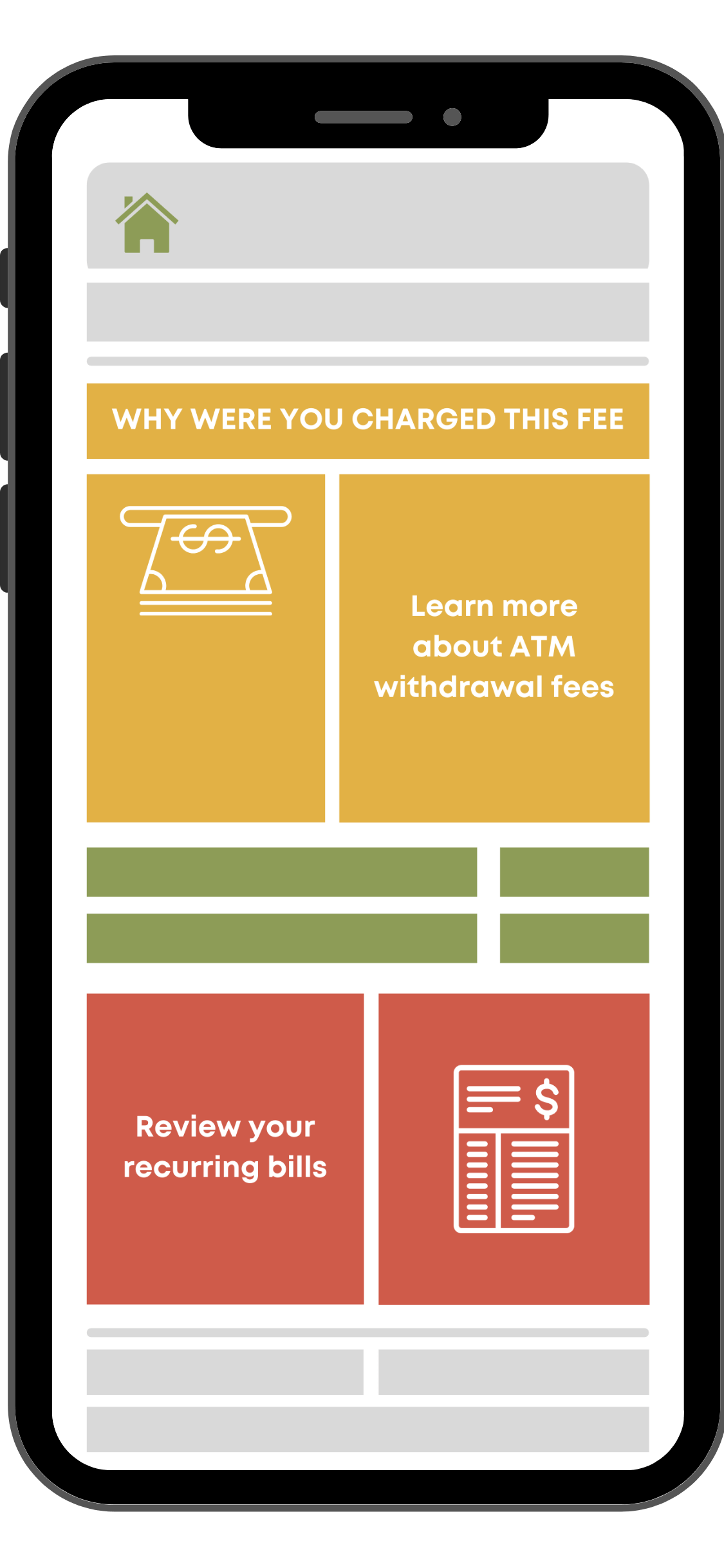

Once customers have an overview of their finances and are able to track spending effectively, the next step in the PFM journey is to provide tools to help them manage their money with as much automation as possible.

These tools can include setting up personalised and automated spending budgets, triggers to manage bills & subscriptions and receiving personalised financial advice. By providing these tools, banks can increase engagement and empower customers to take control of their spending.

Some new notable PFM features leveraging automated processes include:

- Auto-Renewal Management – Customers can track bill payments and schedule notifications to alert them before a recurring payment / contract is due to be auto-renewed.

- Carbon Footprint Tracking – Alert customers to an increase in their carbon footprint and encourage them to set up a carbon footprint budget to help them manage it.

Planning

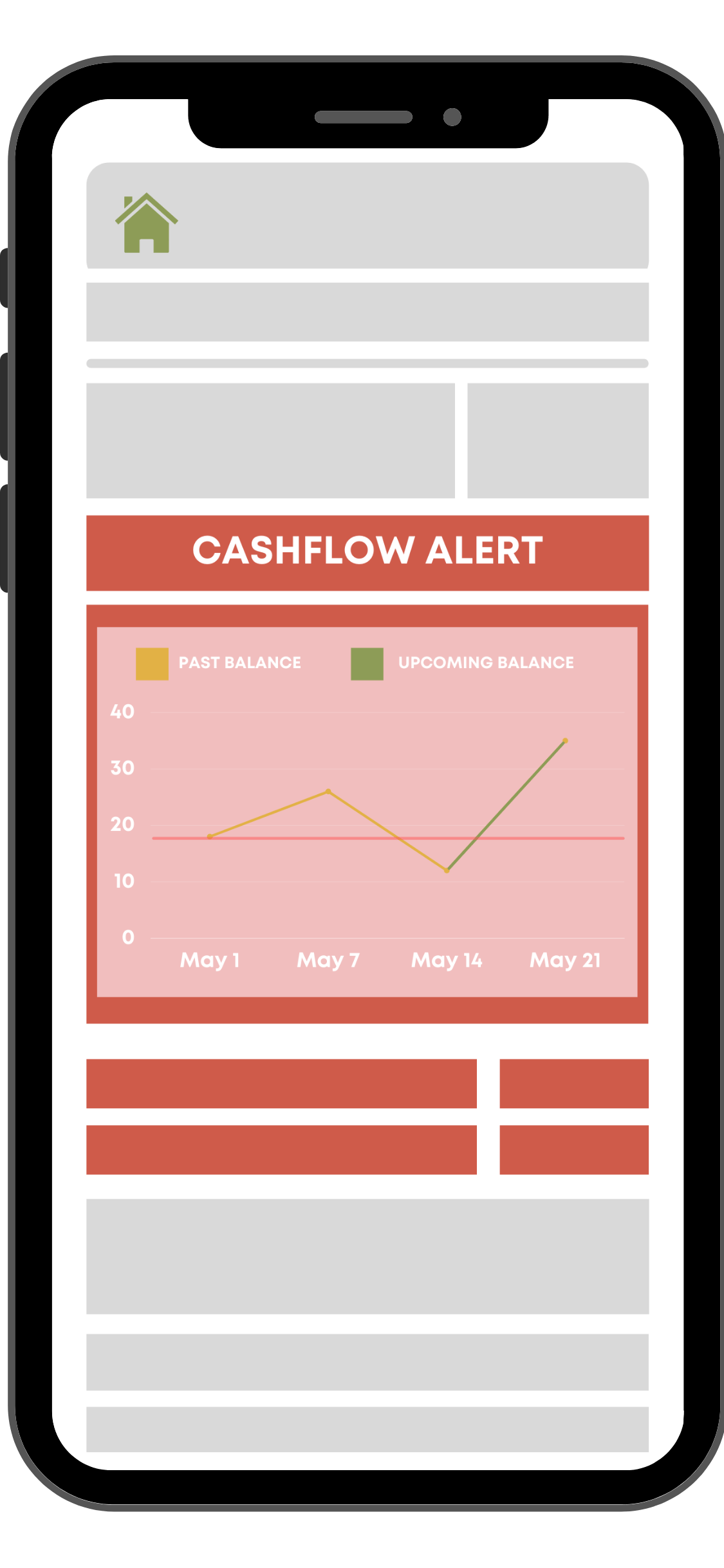

One of the key differentiators between modern PFM solutions and older computer-based offerings in addition to the increased automation is that today’s PFM solutions can not only track past spending, but they can use data to predict future spend and help customers to plan for their future.

Customers can get a better idea of what their financial situation will look like over the coming months and can take steps to ensure they don’t run into issues. By providing predictive insights and forecasts about a customer’s upcoming expenses and income, banks can help customers to avoid financial difficulty.

Planning can also involve encouraging customers to set up savings goals and emergency funds to prepare for their future needs and wants.

“Planning” PFM features include:

- Cashflow Alerts – Notify customers with predictive insights when they might face a risk of overdraft or have an upcoming bill they may struggle to pay with their current balance and suggest alternative options.

Growing

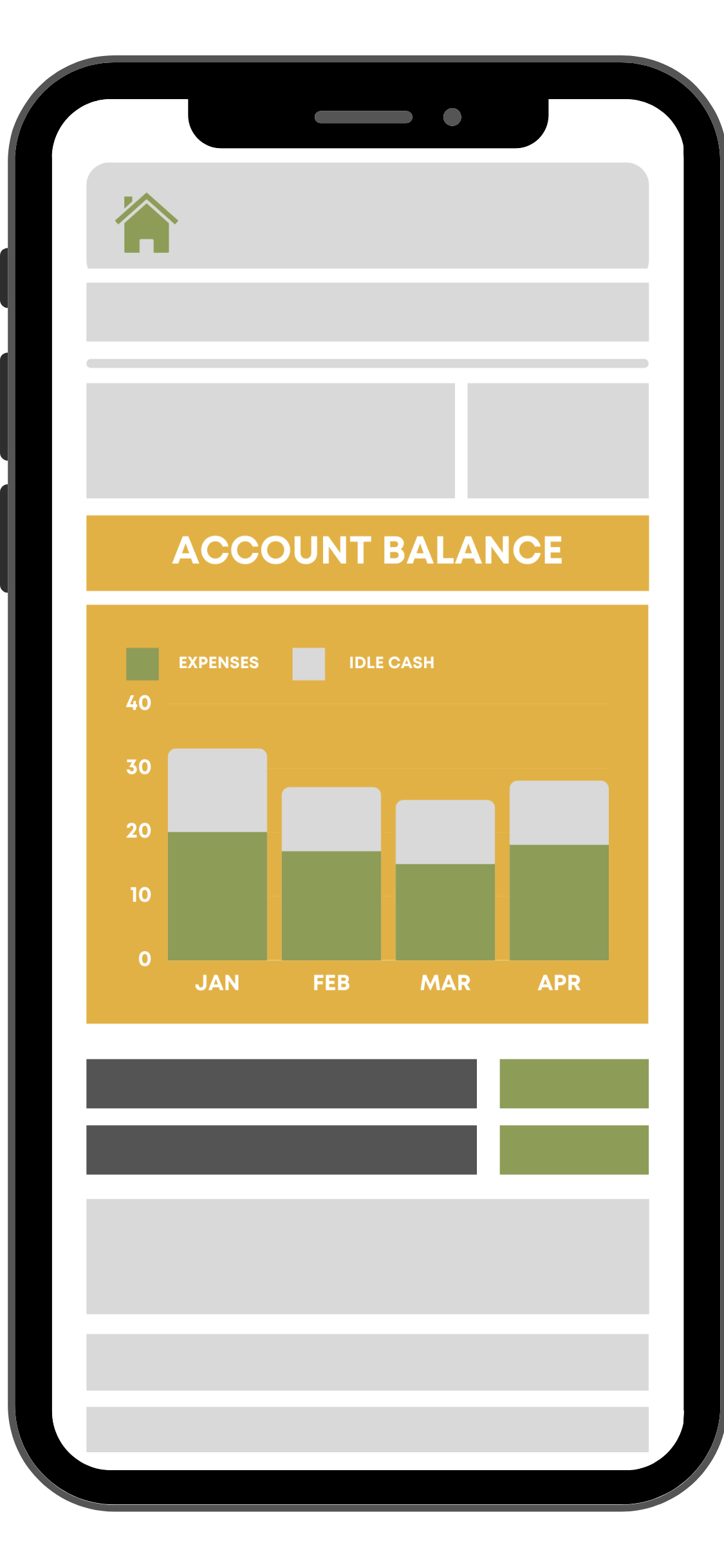

After tracking, managing and planning, the next part of the PFM journey is for customers to grow their wealth.

Banks can suggest products and services like fixed term deposits, savings accounts or investing options that suit a customers’ needs based on their current financial standing and available idle cash. It is at this point of the journey that banks should be encouraging customers to look at their long-term goals and to map out their money so that they can retire comfortably.

“Growing” PFM features include:

- Surplus Cash Alerts – When a customer has surplus cash for a number of months or within a given pay cycle, banks can alert them to various money growing options or investment opportunities which will help them to grow their wealth and put their money to work.

Benefits of PFM Solutions

Implementing PFM solutions has many benefits for both end-user customers who want to manage their finances better and for banks who are looking to engage their customer and increase customer loyalty.

For Customers

PFM tools give customers the ability to manage their finances in an educated, more automated and transparent way leading to better financial planning and overall financial wellness. Customers can use PFM tools to:

- Get a clear and concise overview of their financial situation.

- Take control of their finances by setting and managing spending budgets.

- Set up and track progress of their financial goals and savings.

- Set up notifications and nudges to manage overspending.

- Receive predictive and actionable alerts to help them manage their finances proactively.

For Banks

Traditional banking has been turned on its head and customers now expect more from digital banking services. PFM is a key component for delivering intuitive and personalised digital banking experiences. Banks should implement PFM to:

- Stay competitive. Challenger banks are entering the market with intuitive apps preloaded with proactive and personalised PFM tools. Traditional players are automatically at a disadvantage if they aren’t offering something similar.

- Keep up with customers’ expectations. Customers have become accustomed to having easy-to-access, and easy-to-understand views into their budgets, goals and spending in their financial platforms.

- Increase digital engagement. The more time consumers spend in banking apps, the more exposure they have to a bank’s brand, which will keep it top of mind when deciding on future banking products or services.

Download PFM Solutions for Banks Guide

"*" indicates required fields