The Long Road to Profitability

Growth at all costs is a prominent business model used by B2C fintech firms and new digital banks, virtual banks and neobanks that have recently entered the market. The idea is that they acquire as many customers as possible before their competitors do. Backed with funding and high valuations, companies offer customers improved services for little to no fees. Customers win and new players grow their customer bases by the millions.

But what happens when the funding stops?

How do these digital banking businesses stay afloat with higher expenditure than revenue? There is a new focus on the viability of business models and tech companies are now under pressure to drive not only growth but revenue and even profits too.

In recent months a number of notable fintech companies including Xinja in Australia and Simple, one of the first challenger banks in the US, have wound down, unable to overcome the viability of business challenge.

It is not uncommon for new fintech players to lose money on each new customer that they acquire. What’s more, many don’t have a clear or feasible strategy on how they will convince customers to pay for their services and contribute revenue to the company.

This is a conundrum for many fintech firms, but there are some that are overcoming these issues and are steadily working towards breaking even and not too far from profitability.

This report outlines some of the features and strategies that have supported these businesses on the long road to profitability.

How do Banks Make Money?

Traditionally banks make money from 2 types of income; fee-based income and interest-based income.

- Fee-based income

One way banks make money is by charging fees. These can include account fees, transactional fees such as ATM withdrawal fees, penalty fees and currency exchange fees.

These fees cover the cost of serving clients (and some!) and ensure that banks make money at a very basic level.

For most newcomers, their initial value proposition is that they don’t charge fees and if they do, they charge much lower fees. This makes it difficult for new digital banks to make any significant fee-based income.

The exception is interchange fees that are the small fee paid to a cardholder’s issuer every time a transaction is made. For most newcomers, they rely on these fees and the majority of revenues earned come from them.

- Interest-based income

Interest income is money earned by financial institutions for lending funds. A bank earns interest income by lending money to customers at higher rates of interest than it costs the bank to borrow funds.

Interest income is a hugely important revenue stream for banks. The most profitable products that banks sell are mortgages which are often the largest transaction a retail banking customer will ever make with a bank.

For many new fintech companies, they are not yet in a position to deliver lending to customers, either because of regulatory issues or access to the money needed. While some are offering basic lending services, most of these players are still far from offering more complex products like mortgages.

Challenger banks and large fintechs need to find innovative ways to make money from customers who for the majority still don’t view these as their primary bank. With limited access to traditional banking income like fees and interest income, how can new digital banks actually make money?

How can Challenger Banks Become Profitable?

1. Premium Account Features

2. Marketplace Banking

3. SME Offering

4. Credit Portfolio

5. Wealth Management

Premium Account Features

One way challenger banks are getting around the no-fee business model is by launching subscription-based premium models. These premium accounts come with a number of additional features and offers (not just a snazzy metal card).

Access to Increased Services

As part of these premium packages many challenger banks are offering increased limits on ATM withdrawals and currency exchanges. Those using regular accounts get limited access to these features and so are motivated to move to premium if they use these services often.

Insurance Offering

Many challengers are offering their premium customers some form of insurance product when they sign up. These often include travel and phone insurance policies.

Higher Interest Rates

Some premium accounts are offering higher interest rates on savings to drive more subscription sign-ups. However due to globally low interest rates, it can be difficult for newcomers to make real profit by offering this.

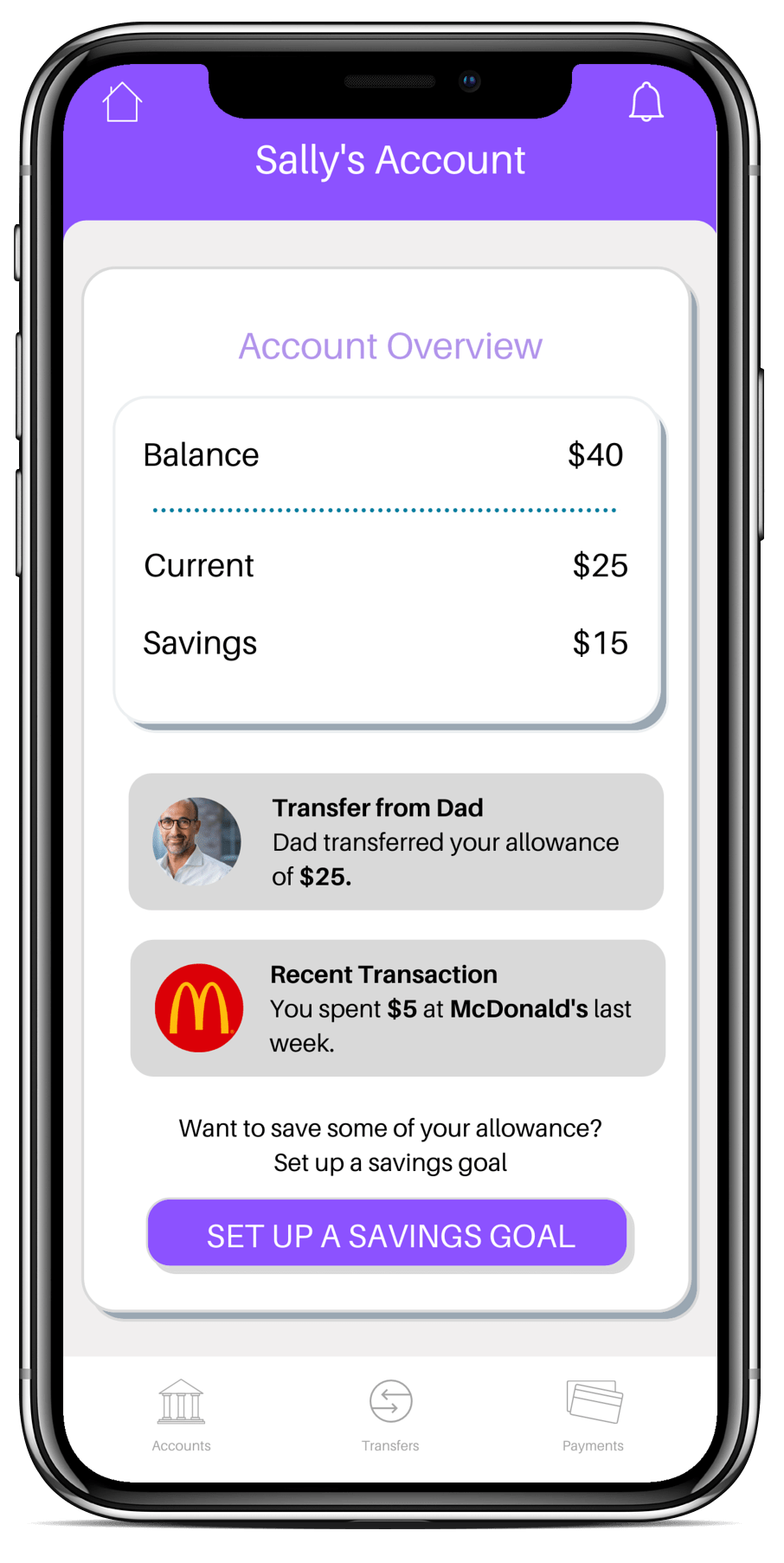

Family Banking

The “family”, “youth” or “junior” account is one that is controlled by the adult but gives children / teenagers the responsibility of managing their own finances and setting them up with good financial management behaviours from a young age.

These accounts are a useful way for parents or guardians to transfer money to an account when needed and to set up various controls around how and where money is spent. Many challenger banks charge customers for these family accounts. which are continuing to grow in popularity amongst customers. They are a good way to sign-up new customers and drive revenue.

Orange Bank, the telco-backed digital bank in Europe, uses the Moneythor solution to deliver a family account to customers and is using this feature to anchor its highest-level premium account offering.

.

.

Marketplace Banking

The marketplace banking model, which some banks are adopting, involves an ecosystem of aggregated products and services presented to a customer, based on their needs and behaviours, all within the financial institution’s digital channels.

A strategic choice that many newcomers and incumbents are adopting is that of building a marketplace in which they can sell on not only their own products & services but those of external parties. By creating a platform where anyone can sell to customers, newcomers can carve out competitive advantage for themselves.

The traditional thinking of banks creating and selling their own products and services, keeping most, if not all, of the supply chain in-house has been turned on its head. The marketplace model goes against this traditional thinking. Hugely successful tech companies like Airbnb and Amazon do not design, create or own what they sell but merely provide the digital marketplace which other sellers can use to promote and sell their products and services. At its core, marketplace banking is about creating extra value for customers.

Starling Bank in the UK, one of the few profitable digital banks, is one such example of a challenger bank that has launched a marketplace of third-party products and services to support and deliver value to its customers.

By creating a digitally driven one-stop-shop platform, digital banks can help customers to seamlessly fulfil their life needs whilst driving engagement and building loyalty.

Asides from delivering increased value to customers, marketplaces can be a good source of revenue for these companies. In most cases, they charge third-party sellers for using their marketplace, gaining access to their customers and associating with their brand.

SME Offering

Penetration amongst SMEs remains limited and they are a notoriously underserved market. They have a broad set of needs and require a broad set of services from their banking partner which, before recent innovations in banking, made them a tough market to serve.

Thanks to digital banking solutions the effort required to serve SME businesses has been reduced. Time for working capital financing approval is shorter and management of business banking areas such as invoicing has been made easier. However, there is still a huge potential in this market particularly for those digital banks looking to turn a profit.

As a general rule, business banking attracts fees. While most challenger banks struggle to increase revenue, those that have most successfully broken-even or turned profitable offer some form of SME/business banking.

Transferwise, the currency exchange and digital wallet provider, attributes its success in reaching profitability to its corporate customers rather than its retail ones.

The SME market can be a lucrative source of revenue for newcomers and can help to balance out potential losses incurred as they strive to increase the number of non-paying retail banking customers.

Successfully delivering business banking services requires rethinking the business banking experiences and using data to provide more personalised services. Data will support banks as they move away from the one-size-fits all model of the past. The SME market is diverse and if challenger banks want to build a profitable SME banking solution, they need to be innovative in their use of technology and data to serve the variety of SME customers that exist.

Credit Portfolio

The reality of banking in an era with low interest rates and continuing battles around low fees, is that banks need to offer lending products to drive real revenue. For many newcomers, the option of lending and offering credit products may be stifled by regulatory barriers leaving them with a tougher road to profitability

For those newcomers who have access to a full banking license and can therefore provide credit products, they should be able to drive profits by charging interest on loans and credit cards.

Nubank – the largest neobank in the world, hailing from Brazil – has been offering a credit card since inception. The bank which has over 25 million customers, is close to breaking even. Its credit card business has been profitable since 2017.

Offering digitally-enhanced credit products can be a good option for increasing income. However, the regulatory costs of being a fully licensed lender are steep and the process of getting licensed can be long.

In key banking regions in Asia, including Singapore and Hong Kong, proactive regulators have created and granted digital banking license to non-banks, giving these license holders the approval to offer lending.

For challenger banks without access to their own licensing, it may be worthwhile to consider working with a licensed partner, to attain regulatory infrastructure and approval for a fee.

Wealth Management

Some challenger banks have launched stock trading platforms where customers can buy and sell stock for a commission or management fees.

Trading and investing is an area of financial services that has been democratised over the last number of years. Investing and trading is no longer exclusive to Wall Street and as customer demand increases for trading tools and services, challenger banks are well placed to deliver them.

By offering trading services like ETFs and auto investing, challenger banks can act as a basic introduction to trading for customers that are keen to start investing. Over time, as their platform evolves, they can offer more complex wealth management features akin to private banking services.

Will Digital Banks Turn Profitable?

For some challenger banks, they are well on their way to reaching profitability. For others, they are waiting until they capture enough of a market share before they make it a priority.

Either way, whether it is now or in the future, there is no doubt that digital banks will have to become profitable in order to stay in business.

There will be many digital banks that fold and others that are acquired by larger players, but that does not negate the fact that there is a need for new digital banking providers or increasing customer demand.

Whichever path to profitability a newcomer chooses to follow, the ones that will be most successful are those that listen best to customers needs and match their expectations with advanced digital banking experiences.

Find out how the Moneythor solution can help you build a successful digital bank.

Download Profitability for Digital Banks Guide

"*" indicates required fields