Banks know that their future growth depends on millennials, a demographic where 34% are concerned about their current and future financial situation. This financially fragile generation is turning away from traditional banking players as they search for easy to use and personalised financial services. This shift in consumer preference is worrying for innovation-averse banks who need to adapt their service offering to appeal to this modern and selective group.

In order to best serve millennials, banks need to firstly understand what it is that they want from their digital banking provider.

What do millennials want from their digital bank?

- Millennials want simplicity.

- Millennials require flexibility.

- Millennials want to use their own channels.

- Millennials want their bank to understand their needs.

- Millennials want simplicity.

Millennials look for convenient digital banking channels that are simple to use. For instance, 62% of Australian millennials decide which new bank to sign-up to based on the ease of use of the accompanying mobile app.

- Millennials require flexibility.

Millennials are taking a flexible approach to digital banking. They want the freedom to control their finances in a personalised way and will often integrate new digital banking services in addition to their primary bank in order to achieve this. 61% of 18 to 34-year-olds in the United States have adopted new digital banking services alongside their traditional bank. In other geographies this number gets higher; 70% in Germany and 74% in Australia.

- Millennials want to use their own channels.

Traditional channels don’t have the same appeal to millennials as they may have had to other generations. Millennials want to interact with providers on platforms that are already a part of their day-to-day, such as messaging apps. 97% of Australian millennials say they’re comfortable interacting with a bank on a messaging app, the same is true in the UK (92%) and in Germany (91%).

- Millennials want their bank to understand their needs.

Millennials trust their banks more when they feel understood by their financial provider. In the US, 67% of millennials trust a bank which understands them. Similarly, 61% of millennials in Germany, 60% in Australia and 55% in the UK feel the same.

How can digital banks provide millennials with the financial service offering they are looking for?

- Focus on user experience.

- Provide flexible options.

- Be where millennials are.

- Show millennials that you understand them.

- Focus on user experience.

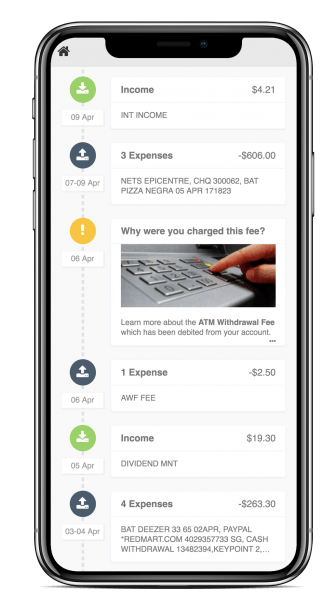

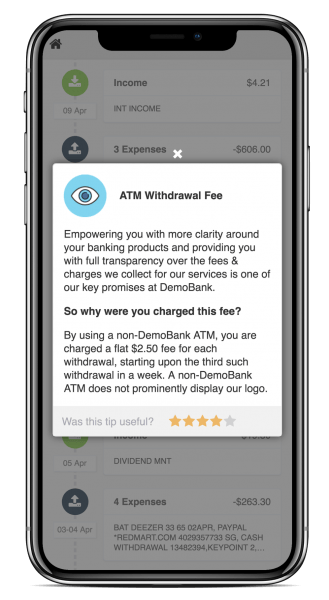

Banks need to deliver customer-centric digital experiences that simplify financial management and engage customers whenever they are logged-in. By offering speedy app load times, clear overview of current finances and additional app capabilities such as financial literacy tips, banks can make banking simpler and easier to comprehend. Below, you can see an example of user-friendly, personalised financial literacy tips that are powered by Moneythor’s software.

.

.

- Be flexible.

Banks’ digital channels should try to become a foundation on which users can add and build onto in order to achieve their desired financial platform. Banks and other traditional players need to offer users freedom and control over their finances by giving them the tools to build their desired financial system.

This can be a big investment of both time and money for banks but can be made simpler by partnering with external fintech companies who may have already dedicated the time and resources to creating the functionality millennials are after.

- Be where millennials are.

Banks need to integrate messaging apps into their communication strategies in order to stay relevant amongst this phone-call-allergic group. Conversational user interfaces such as chatbots are making messaging apps a cost-effective way to talk to consumers and provide a more efficient service.

- Show you understand.

There is an opportunity for banks to build trust amongst millennials by offering a more personalised banking experience. By offering personal financial management (PFM) tools, financial literacy materials, and relevant offers, financial providers can build a more personalised and authentic relationship with their customer base and show millennials that their financial situation is understood.

In summary, millennials expect a lot from their banks and other financial services providers, meaning that traditional players and new entrants alike need to focus on flexibility, ease of use and personalisation in order to provide the exceptional customer experience this generation are after.

Blog post updated July 2020