Introduction

In the ever-changing landscape of personal finance, traditional savings mechanisms often face difficulties in engaging and motivating individuals to maintain consistent saving habits.

With the emergence of various alternative investment options and the allure of immediate gratification through consumer spending, the appeal of traditional savings accounts can sometimes diminish.

Additionally gambling-related issues continue to pose significant challenges to financial well-being, affecting individuals and communities worldwide.

This gap between traditional savings offerings and evolving consumer preferences highlights the need for innovative solutions that effectively incentivise saving behaviours while aligning with modern financial trends.

In this context, Prize-Linked Savings Accounts (PLSAs) emerge as a compelling solution, blending the allure of potential rewards with the discipline of savings, thereby incentivising regular saving behaviour while concurrently addressing concerns related to gambling.

What are Prize-Linked Savings Accounts (PLSAs)?

Prize-linked savings accounts (PLSAs) merge the conventional concept of savings accounts with the excitement of lotteries and prize draws. These hybrid financial products are crafted to incentivise individuals to save more by offering the opportunity to win prizes alongside accruing interest on their savings.

The origins of prize-linked savings can be traced back to 1694, when the British government introduced a lottery to finance the nation’s war efforts against France. Since then, lotteries have served as a revenue source for various governments in the form of Prize Bonds in Ireland and Bonus Bonds in New Zealand.

In the 20th century, the concept evolved further, for instance in the United States, where several credit unions began offering prize-linked savings accounts.

Online platforms and mobile applications have made it easier for individuals to participate in these programs, enhancing accessibility and broadening participation among the population.

While PLSAs have been around for some time, they are now gaining traction in countries worldwide as a strategy to foster financial literacy, encourage sound savings habits all the while adding an element of fun and avoid the financial wellbeing pitfalls of gambling.

Prize-linked savings combine many digital banking techniques such as money management, loyalty programs, and gamification.

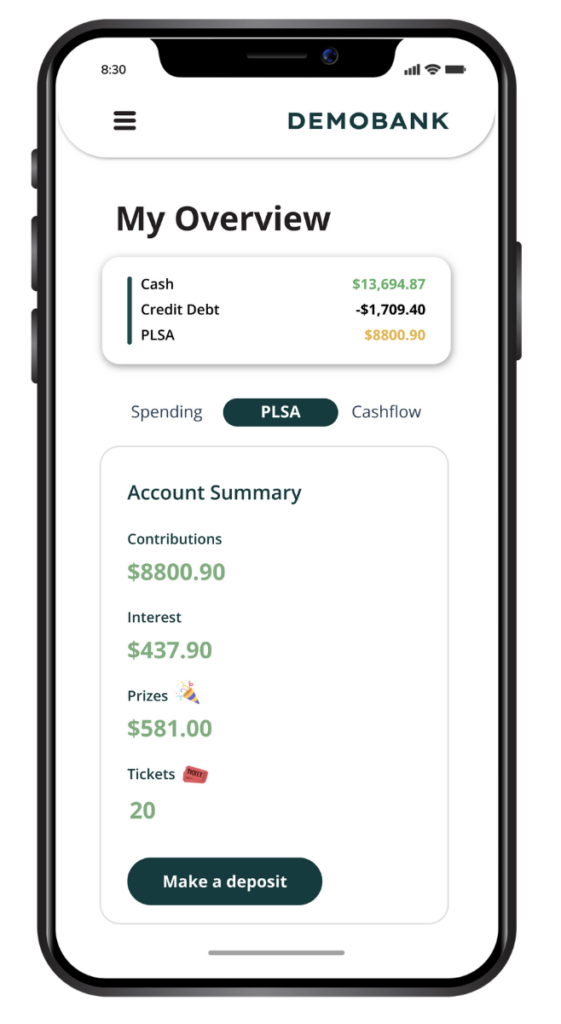

How do prize-linked savings accounts work?

Prize-linked savings accounts (PLSAs) work by combining traditional savings accounts with the excitement of lotteries and random prize drawings. Here’s how they typically operate:

1.Customers make deposits

Customers make deposits into their PLSA as they would with any regular savings account or goals. These deposits are typically made in small increments, potentially leveraging auto-saving techniques, such as round-ups, smart sweeps or salary splits.

2. Customers earn prize draw entries

For predefined thresholds of money deposited or frequencies of contributions, customers earn entries into a prize draw. The more money saved, the more entries received, rewarding consumers of for their healthy financial habits.

3. Winners are selected

Periodically, for instance on a monthly or quarterly basis, a draw is held to select the winners, usually funded by a simple revenue share of the interest earned by the financial institution. Prizes may include cash rewards, gift cards, vouchers or other valuable items.

4. Interest is earned on savings

In addition to the chance of winning prizes, participants in prize-linked savings accounts still earn interest on their savings, providing the potential for higher returns compared to traditional accounts.

What are the benefits of prize-linked savings accounts?

Prize-linked savings accounts offer several benefits for individuals looking to save money and for banks looking to encourage engagement and increased deposits.

Incentivises saving

Prize-linked savings accounts provide an additional incentive to save by offering the opportunity to win prizes. This can motivate customers to deposit regularly into their savings account.

Drives increased engagement

The chance to win prizes adds an element of excitement and enjoyment to the saving process, making it more engaging and rewarding. By adding additional gamified experiences, banks can further increase levels of engagement.

Encourages financial literacy

Banks can use these prize-linked savings programs, as an opportunity to share financial literacy tips and to help customers learn valuable financial skills such as budgeting and goal setting.

Accessible to everyone

Prize-linked savings accounts are often designed to be accessible to individuals of all income levels and financial backgrounds, helping to promote financial inclusion and positive financial behaviour across various customer segments.

Positive customer experience

Unlike traditional gambling, participants in prize-linked savings accounts do not risk losing their savings. Even if they don’t win a prize, their savings remain intact and continue to earn interest leading to an overall positive experience with the bank, regardless of lottery outcome.

How can banks successfully implement prize-linked savings accounts?

Personalisation

Tailoring PLSA experiences to individual preferences and financial goals can significantly boost engagement and participation. Banks can implement personalised savings goals and rewards structures based on customer profiles and behaviour. For example, offering customised prize options or savings challenges aligned with specific savings objectives can make the PLSA experience more relevant and appealing to customers. Additionally, providing personalised financial advice and recommendations through digital channels can help customers make timely and contextual decisions about their savings strategies.

Gamification

Incorporating elements of gamification into PLSAs can make saving more enjoyable and motivating for customers. Banks can introduce interactive features such as progress tracking, achievement badges, virtual rewards and leaderboards to create a sense of accomplishment and competition among participants. Gamified challenges and quests can encourage regular savings habits and incentivise customers to reach their savings goals. By making the savings journey engaging and interactive, banks can increase customer satisfaction and retention while driving higher levels of savings participation.

Money Management

Effective money management is fundamental to the success of PLSAs. Banks can provide customers with tools and resources to track their spending, set budgets, and manage their finances more effectively. Integrating money management features into PLSA platforms can help customers monitor their ability to contribute more to their savings, identify areas for improvement to earn more chances, and make informed decisions about their financial goals. By empowering customers with the skills and tools they need to manage their money wisely, banks can enhance the overall impact of PLSAs and promote long-term financial well-being.

How Moneythor can help banks to implement prize-linked savings accounts?

The Moneythor platform offers a comprehensive solution for implementing prize-linked savings accounts (PLSAs), leveraging its unique capabilities in blending money management, loyalty, personalisation, financial literacy, and gamification techniques.

With Moneythor, financial institutions of all sizes can seamlessly integrate PLSAs into their customer journeys, providing customers with a rewarding and engaging savings experience. Additionally, Moneythor enables auto-savings techniques like roundups, smart sweeps, salary splits and more, making it easier for customers to save regularly and effortlessly.

The Moneythor loyalty features facilitates the management of prizes, whether they are cash rewards, points, gift cards, vouchers, or other items, ensuring a seamless and efficient prize distribution process.

Through the various features and functionalities that Moneythor offers, banks can effectively implement PLSAs and promote healthy and engaging savings programs for their customers.