What is a carbon footprint and how can digital banking play a role?

As the global shift towards sustainability and climate change action continues, an urgent need for tools, services and platforms that help manage a person’s environmental impact has emerged.

Globally, people have become more concerned about the wellbeing of the planet and are taking decisive steps to play their part in reducing the negative impact they have on climate change.

This move towards sustainability is having a massive impact on consumer behaviour. Shopping patterns, eating habits and energy consumption have all been impacted by the modern desire to protect the planet.

At an individual level, customers are more concerned than ever with their carbon footprint and the impact that they as a single person are having on the environment.

In the definition from the World Health Organisation (WHO):

“A carbon footprint is a measure of the impact your activities have on the amount of carbon dioxide (CO2) produced through the burning of fossil fuels and is expressed as a weight of CO2 emissions produced in tonnes”.

While it is beneficial to have an understanding of your carbon footprint, tracking emissions can be a complicated process. Everything we do produces some level of carbon, making it difficult to track.

It is virtually impossible to be carbon neutral, however, it is possible to reduce the amount of carbon a person consumes. With this goal in mind a number of tracking devices and calculators have become available that provide an overview of how much carbon certain actions and behaviours are producing. Knowing your carbon footprint is the first step in finding ways to reduce it.

Most of these calculators require a lot of manual input and can make tracking your footprint difficult. This is where transaction data and digital banking can play a role in simplifying this process.

How does it work?

With so many sources of carbon emissions, working out a carbon footprint can be a complex process. How can we track relevant activities and assign the correct CO2 weight?

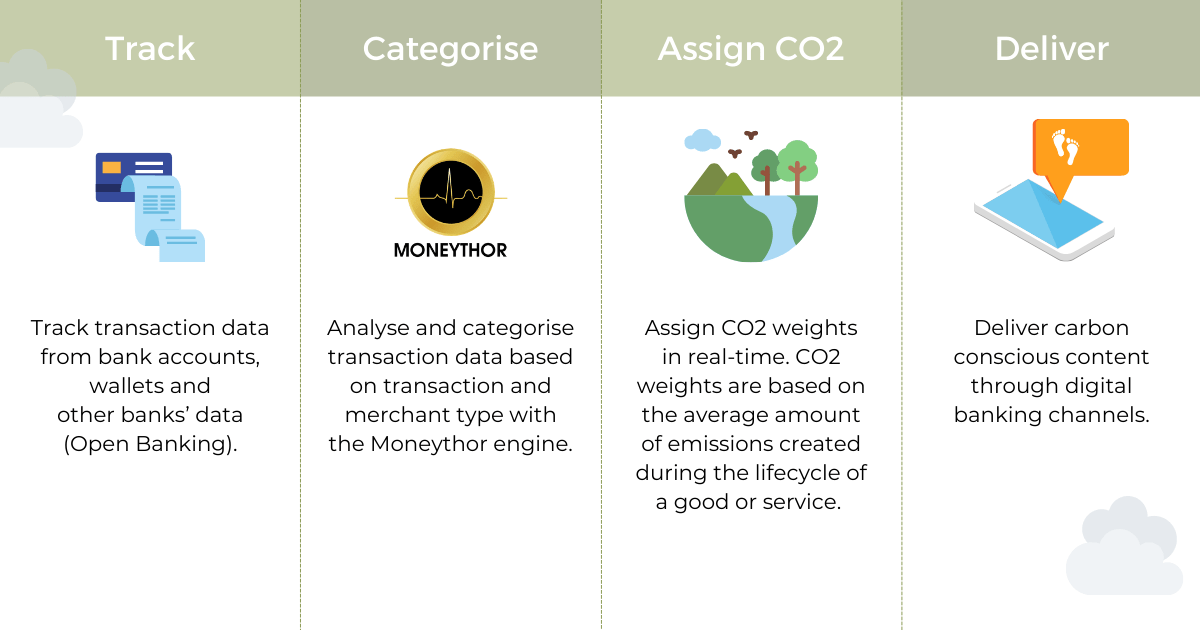

One efficient way to do it is to use transaction data to estimate a customer’s carbon footprint. Data analysis engines like Moneythor’s can quickly analyse, classify and enrich transaction data, making it easier for a customer to understand and manage their financial situation.

In order to track the carbon footprint, a pre-calculated CO2 weight based on each transaction category (e.g. air travel, clothing, dining, etc.) enhanced with the detection of known merchant details (e.g. green electricity providers or eco-friendly sustainable businesses) and further adjusted by individual lifestyle preferences is assigned to each transaction.

The CO2 weight, which is measured in kilograms, is assigned in real-time and is based on the average amount of emissions created during the lifecycle of a good or service.

CO2 emissions are calculated by looking at the types of CO2 being emitted at different stages of the lifecycle of a product. The main types of CO2 emission include:

- Embodied CO2

This is any CO2 emissions that occur during the supply chain and production of a good.

- Use-phase CO2

This is the CO2 released during the use of good or service.

- End of life CO2

This is the CO2 that is emitted during the destruction of a good e.g. recycling / landfill.

The CO2 weights and averages change country-to-country, so the averages and the related emission factors are generally better determined by local specialist environmental agencies. Once the CO2 weight has been assigned, this data can be used to deliver personalised and contextual experiences to customers based on their spending, behaviour and actions.

Carbon Footprint Use Cases

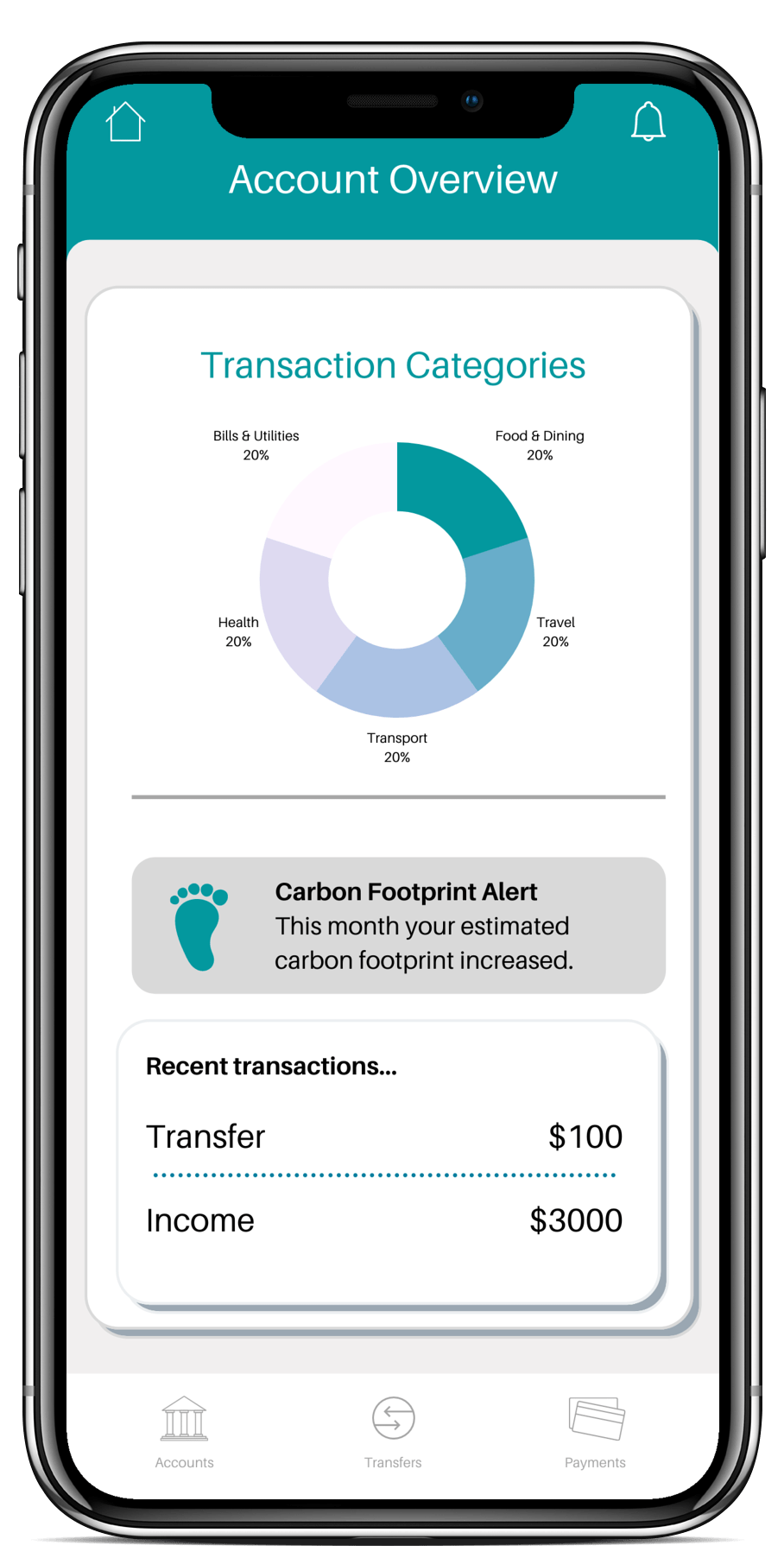

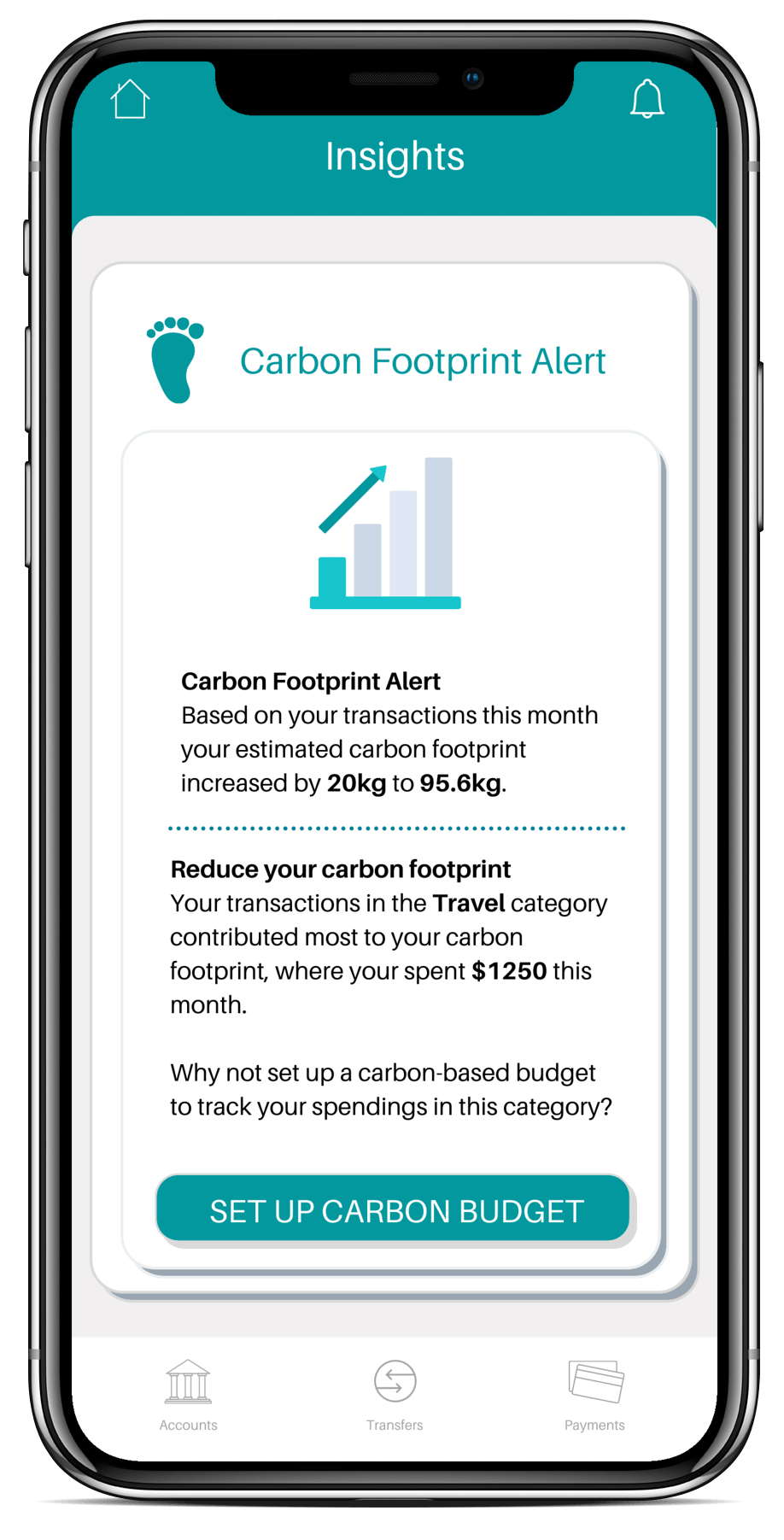

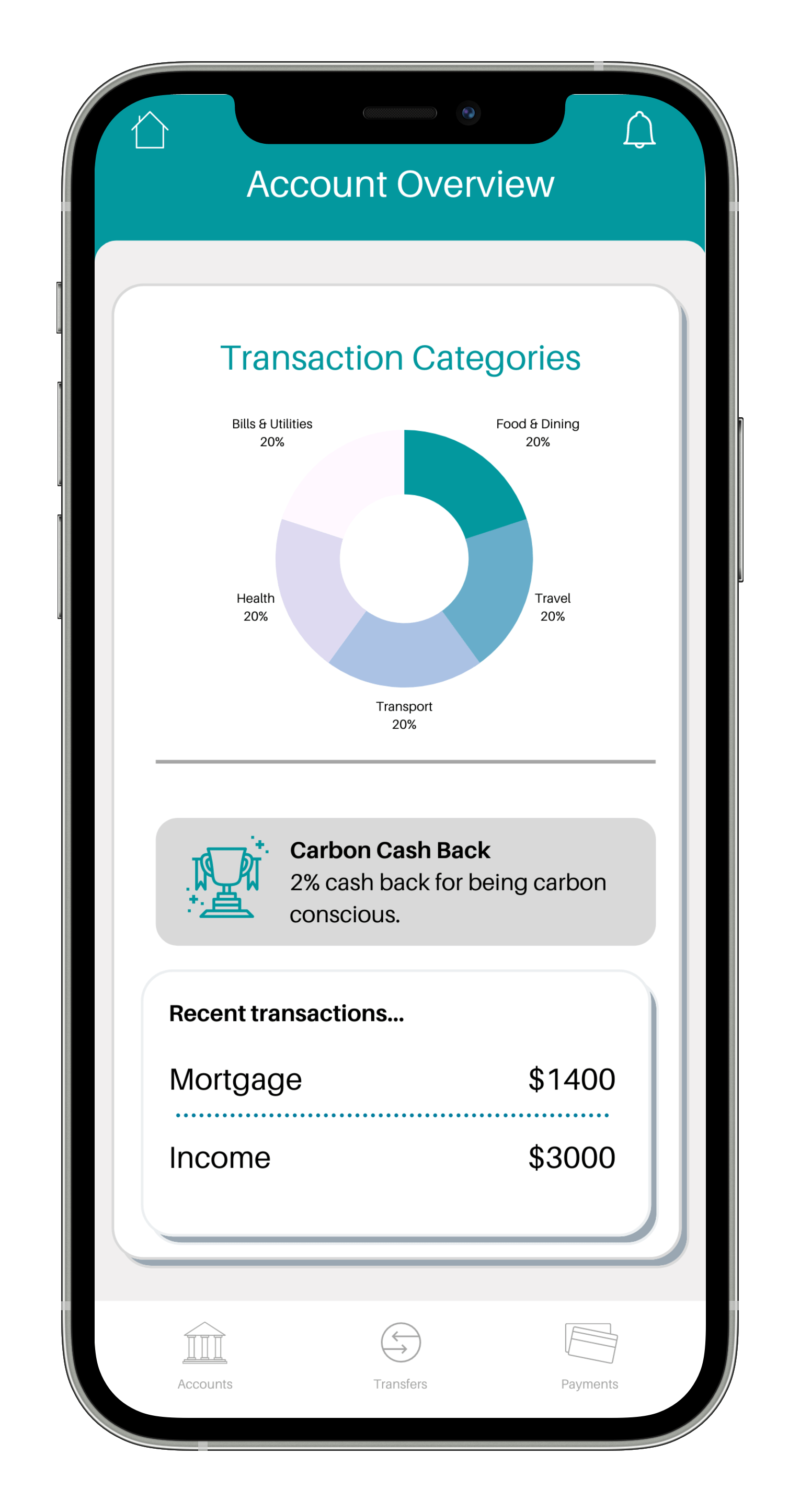

The results of assigning CO2 weights to transactions can be shown within a mobile banking app, internet banking portals or through personalised trigger-based messages.

Once CO2 emissions have been tracked and assigned, the options for the delivery of carbon footprint based content are endless. Some examples of carbon footprint use cases we have implemented include:

- Detecting Changes in CO2 Emissions

- Carbon Footprint Budgets

- Carbon-conscious Rewards

Detecting Changes in CO2 Emissions

After analysing transactions and assigning CO2 weights, the Moneythor engine can track any increases or decreases in carbon emissions and alert customers to the changes with tailored insights and calls to action.

.

.

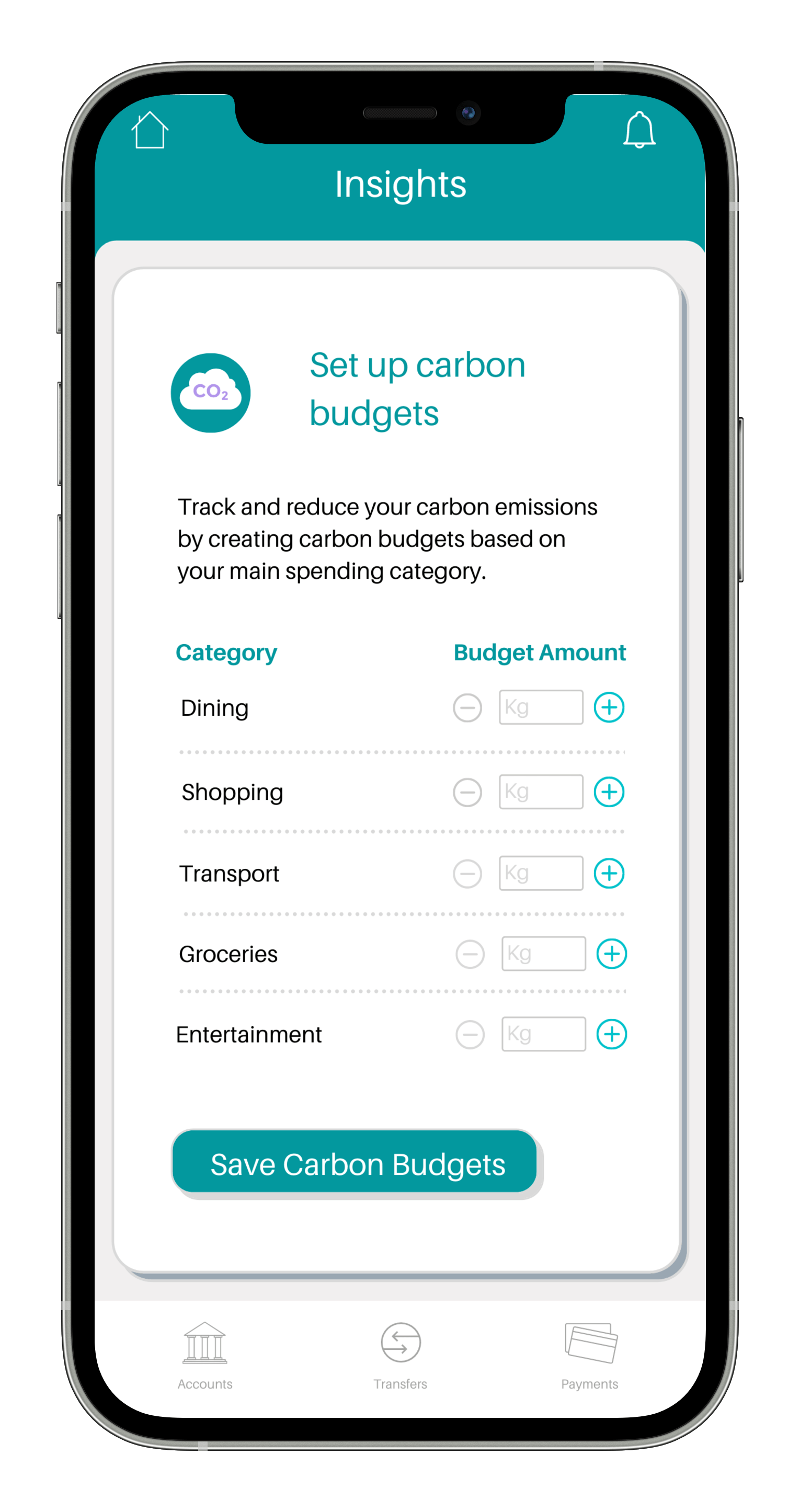

Carbon Footprint Budgets

After informing customers about any variation in their carbon footprint or simply following a personalised insight on the topic, you can provide the option for setting up a number of budgets tracking CO2 weights in kilograms against relevant spending categories.

This is a straight-forward alternative to the traditional budgets offered in personal financial management (PFM) solutions based on transaction amounts expressed in fiat money and local currencies.

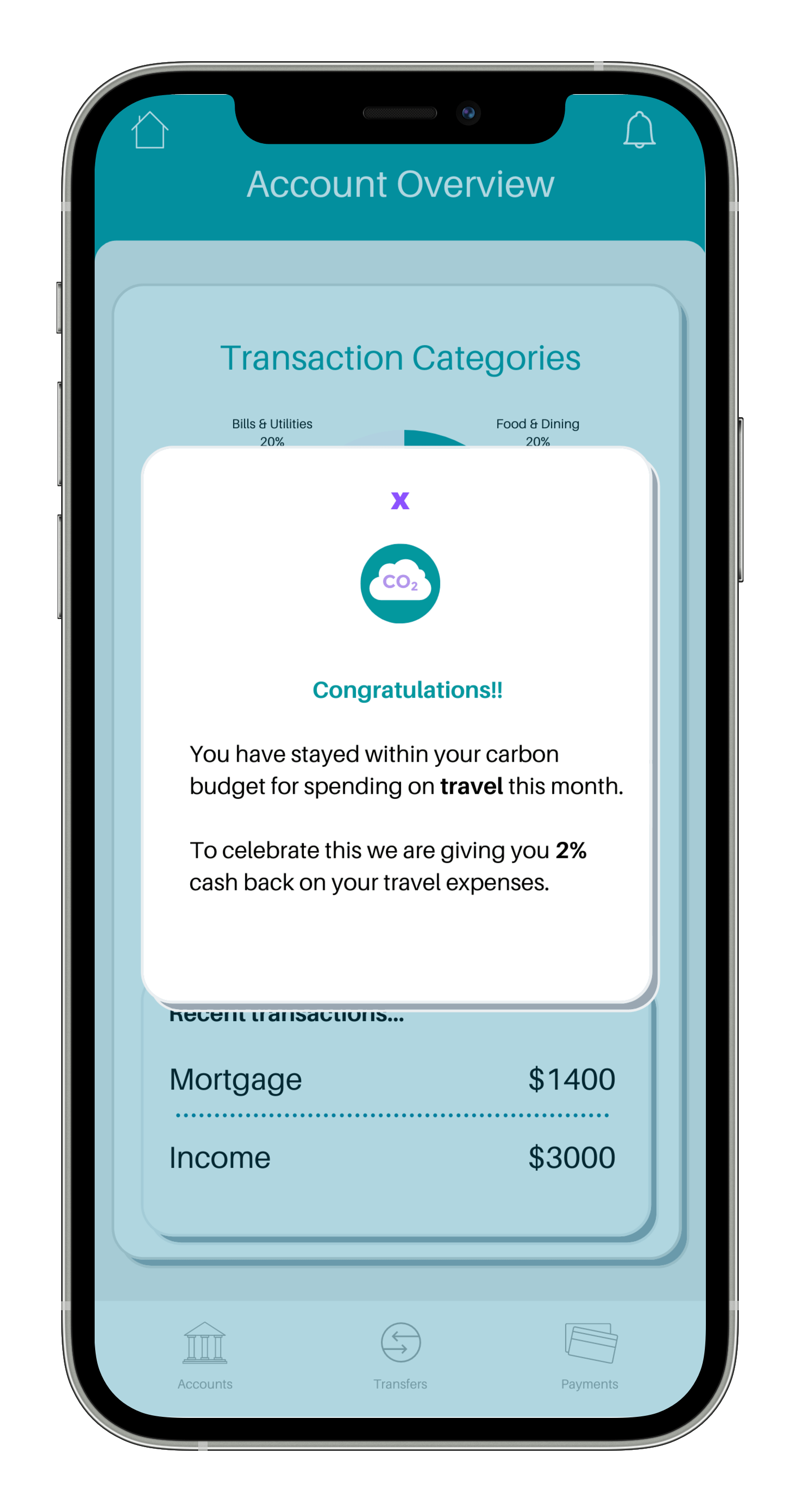

Carbon-Conscious Rewards

Reward customers for making carbon conscious decisions such as staying under their carbon budget or shopping at eco-friendly merchants, and hence reducing their carbon footprint.

Run rewards campaigns and loyalty programmes that promote sustainability and reductions in carbon footprint.

.

.

Benefits of Carbon Footprint Tracking

- Improves ESG Performance

Environmental, Social & Governance (ESG) performance is a growing consideration in company valuations. There is now a broad consensus about the positive link between ESG performance & financial performance. Carbon footprint tracking contributes positively to ESG performance and in effect benefits overall performance of the business.

- Enhance Brand Reputation

The various dimensions of sustainability are positively associated with corporate reputation, meaning that sustainability efforts like a carbon footprint tracking tool, can enhance the reputation of a company, increase brand value and position banks as leaders in sustainable finance solutions.

- Increase Engagement

Customer preference for sustainable solutions is growing. Offering value-add services like carbon footprint insights can increase engagement and drive loyalty. Enhance financial wellness programmes and engage customers by providing them with tools and solutions to help them live more sustainable lives.

- Differentiate Product Offering

Banks are under increased pressure from new entrants such as neobanks and new regulation such as Open Banking to upgrade the experiences they offer to customers. Offering valuable content such as carbon footprint trackers and insights will help to differentiate banks from competitors and provide competitive advantage.

Download Carbon Footprint Tracking Guide

"*" indicates required fields