The importance of data in modern business and banking cannot be underestimated. Every interaction a customer has with a bank leaves a trail of data and information, which can be used to provide customers with personalised experiences, reduce fee discrepancies or improve internal systems and processes. Teams of data scientists are being employed globally to mine and use data effectively to drive revenue for banks.

However, it is not just data scientists who have to deal with data. Data flows throughout the entire organisation, impacting all areas of the business and crossing all teams’ paths, influencing decisions and changing the trajectory of plans and processes.

Data has been compared to oil and air and it is set to become the next bankable asset. With that in mind, banks are investing heavily in systems and tools that will help them to manage and utilise data effectively. While this is worthwhile for banks to do, being a data-driven organisation takes more than just system updates. Creating a data-driven organisation means integrating data into all areas of the business and having teams at all levels and in all departments that can read, understand and use that data.

This is where data literacy comes in. Gartner defines data literacy as ‘the ability to read, write and communicate data in context, including an understanding of data sources and constructs, analytical methods and techniques applied – and the ability to describe the use case, application and resulting value’.

Poor data literacy is a roadblock to growth and transformation for banks and as data becomes further integrated into daily workflows, it will only heighten the need for increased abilities to work with data. Maintaining competitive advantage requires greater access to and understanding of data across the organisation.

According to a survey by QLIK, only 24% of business decisions makers are fully confident in their ability to read, work with, analyse and argue with data. This research highlights the skills gap that exists between the level of data literacy that is needed from employees and what currently exists.

How can banks improve the data literacy of their employees?

Banks should focus on integrating data into all areas of the business in order to steer the organisation forward into the 4th Industrial Revolution.

- Training

One of the most important ways of providing employees with the requisite skills to effectively manage data is to set up training plans and programmes for everybody in the organisation. Training plans can be effective regardless of whether they take place online or in-person. As long as employees are given the support, time and resources needed to complete the training it will greatly improve the overall data literacy of the organisation.

- Simplified terminology

As with any business entity there will be a certain amount of business jargon that is associated with data science, this can make it difficult for those outside the department to follow the conversation and understand what is being talked about. In order to make data seem more approachable and understandable, data scientists should try to use simplified terminology with those outside of their department to ensure that everyone understands what is going on and give them the confidence to partake in data discussions.

- Access to tools

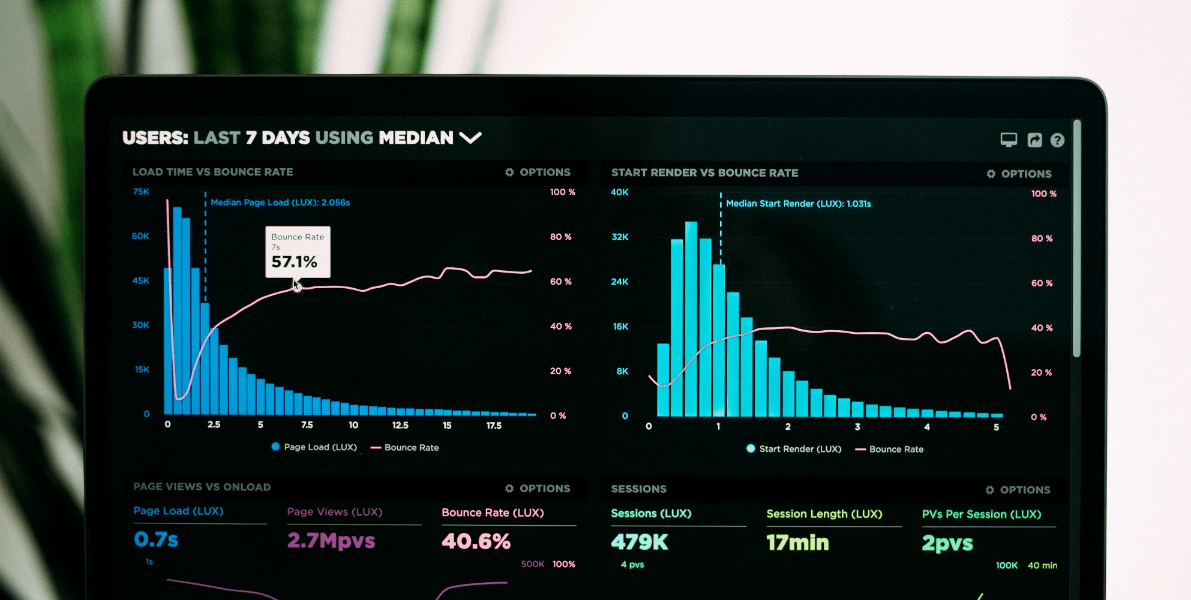

Analytics and datasheets may be a data scientist’s best friends, but for a person with poor data literacy they can be a minefield. Creating tools and dashboards that highlight key insights and make it simpler for employees to understand will reduce teams’ reliance on data scientists and allow them to make data-centred decisions quickly and efficiently.

- A data-driven culture

Redefining a culture takes time, perseverance and support from leadership teams. In order to adopt a data-driven culture, it must be a priority that is pushed and promoted from the leadership team. Internal communications, events and trainings will help to strengthen a data-centred culture. Rewarding people who are effectively using data will also help to show the value of gaining these new skills for both employees and the organisation.

It is important that banks consider the data literacy of employees at all levels within the organisation. By ensuring that employees have access to and the ability to work with data they can create a data-centric culture which will lead to better decisions being made and better experiences being provided for customers.

Blog post updated October 2020