2019 was a year of change for the banking industry. During the last 12 months we witnessed the rise of challenger banks with players such as N26 and Monzo hitting big milestones such as a US launch and 3 million active accounts respectively.

It was also the year that big tech finally made the move into finance. Google announced plans for its current account offering, Facebook began work on its ill-fated Libra project and Apple launched its own (metal and aesthetically pleasing) credit card.

It wasn’t just big tech that was busy in 2019, financial regulators around the globe were busy introducing new regulations positioned to spur on advancement in the finance industry. PSD2 became official in Europe (although partially delayed until 2020) and countries like Singapore, Malaysia and Australia introduced their own policies on open banking.

Throughout the last 12 months, there has been a lot of interest in digital banking licenses. Hong Kong, Singapore, and Malaysia paved the way by offering non-bank entities the opportunity to offer banking products and services to their customer bases under new licensing schemes. In Hong Kong, 8 of these licenses were granted to big names such as Tencent, Xiaomi and Alibaba and applications for the licenses have been accepted in Singapore, from the likes of Grab, Razer and possibly Tik Tok owner Bytedance.

With such a busy year behind us, what can we expect for 2020? Here are some of the key trends to watch in 2020.

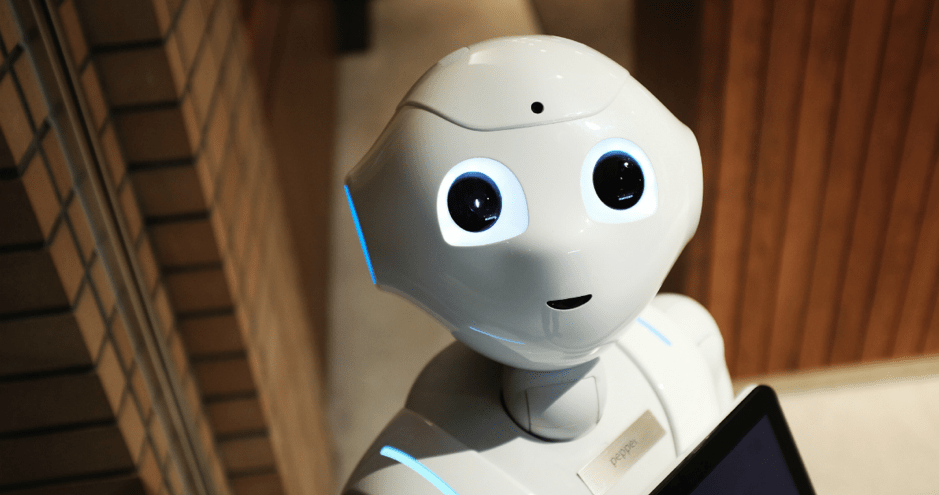

Artificial Intelligence

The opportunities for AI in banking are boundless and to date we have only touched the surface of what this technology can achieve in banking. 2020 is set to be a big year for AI in banking with leading financial institutions committing more money to its research and development than ever before. According to Business Insider research, 75% of large financial institutions are in the process of implementing AI strategies, with their benefits set to be seen this year.

Digital transformation

Digital transformation in banking will no longer be only on the agenda for early adopters, but those banks that have previously fallen behind will be required to move away from legacy systems and implement strategies and services that support the needs and expectations of customers in 2020. While previously companies would have been applauded for their transformation exercises, in 2020 it will be the norm with those who do not change their systems and processes falling quickly behind.

An early sign of this is Mitsubishi UFJ Financial Group (MUFG)’s announcement last week, naming Hironori Kamezawa as the bank’s new Chief Executive Officer. Kamezawa, who moves to the top spot from his previous role as Chief Digital Transformation Officer, is an experienced digital banker and mathematics graduate who will be charged with accelerating the banks digital efforts.

Platform-based Banking

The effects of Open Banking, lenient regulation for fintechs and customer demands for end-to-end customer journeys have paved the way for Banking-As-A-Service to emerge as a legitimate revenue model for traditional players. By giving third-party providers access to core systems and functionality, banks can attract new customer bases and create new revenue streams.

Cloud Computing

The cloud has been the go-to server system for challenger banks and has positively contributed to their speed to market, improved customer experiences and ability to reduce costs.

While most banks still rely on on-premises server systems, there has been a shift in the last number of years, with traditional players moving to the cloud in order to take advantage of the benefits that their modern counterparts already leverage. In 2020, we expect to see more banks move to the cloud in general and specifically, more will move to the public cloud platforms.

Open Banking

At the beginning of the year, there were high expectations for Open Banking initiatives. It was supposed to change the way we bank completely and irrevocably. Unfortunately delays in Europe meant that it did not have the initial impact it had been hoping for. We now turn to 2020 with the optimism we had this time last year and look forward to seeing Open Banking really make its mark. We expect it to become mainstream in the UK and Europe with an increase in general public understanding. Added to that more and more people will be using Open Banking-powered applications. Open banking is already spreading around the world and we expect this globalization to continue as more regulatory bodies introduce Open Banking programmes.

Data & Personalisation

Technology advances have given banks the ability to analyse and categorise exponentially more data about their customers than ever before. In 2020, more banks will start to use this data effectively to provide customers with the personalised experiences that they have come to expect. Data and personalisation will become the new battleground for traditional banks and challengers, with customers choosing their bank based on the level of customisation and support they receive through a bank’s digital channels. Data has emerged as a key strategic element for banks and in 2020 we will see this used as a competitive advantage for those banks that have already invested in personalisation.

2019 was an exciting year for financial institutions and 2020 is set to continue the move towards more digitalised, open and personalised banking products and services that not only improve customer experience but positively affect a bank’s bottom-line.