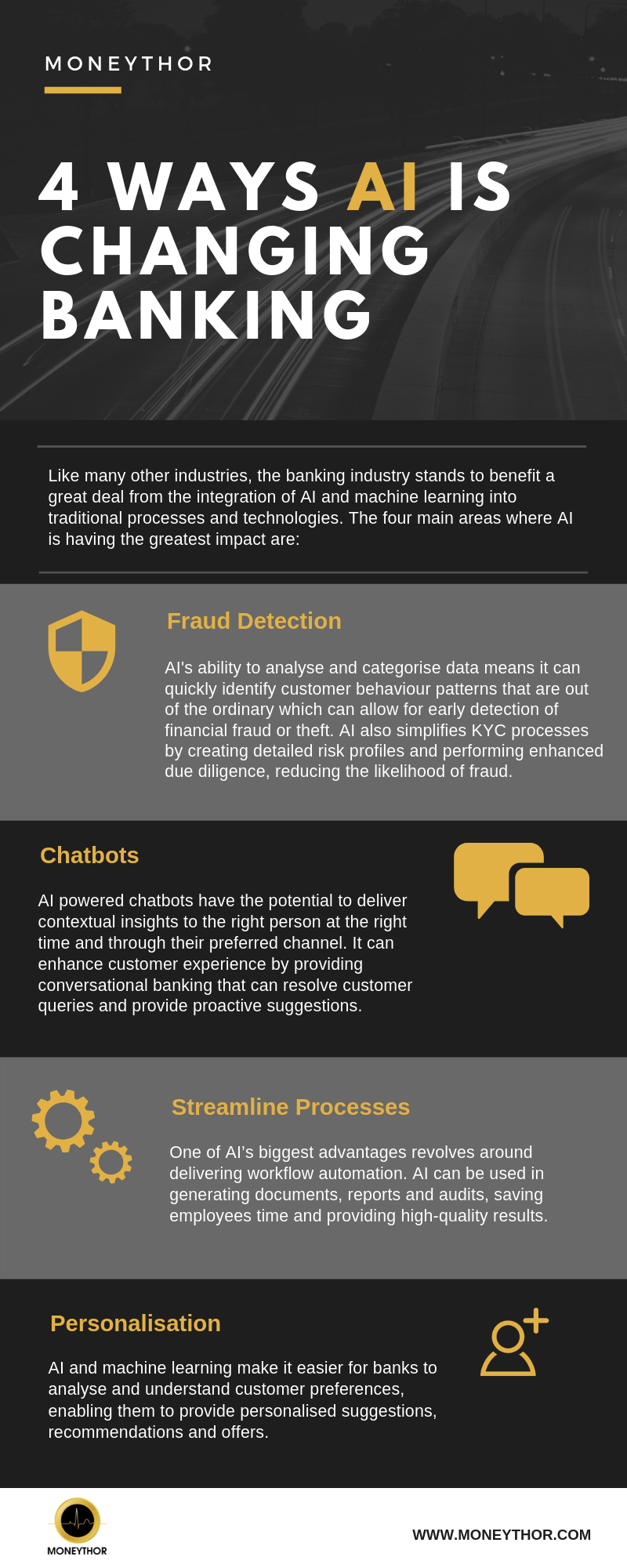

Modern technologies like AI and machine learning are changing the way we carry out both simple and complex tasks and are already having a huge impact on the way we live our lives. Like many other industries, the potential for AI and machine learning to disrupt the financial services sector is massive. As this technology is further integrated into digital banking solutions, it will have adverse effects on the way customers bank and manage their finances.

What are some of the ways AI is changing digital banking?

- Intelligent fraud detection.

- Conversational chatbots

- Streamlining internal processes.

- Personalised experiences.

- Intelligent fraud detection.

AI has the ability to analyse and categorise data which means it can quickly identify customer behaviour patterns that are out of the ordinary and allows for early detection of financial fraud and theft.

AI simplifies the KYC process by creating detailed risk profiles and performing enhanced due diligence, reducing the likelihood of fraud.

- Conversational chatbots.

AI powered chatbots are able to deliver contextual insights to the right person, at the right time and through the customer’s preferred channels.

Contextual chatbots enhance the customer experience by providing conversational banking that can resolve customer queries, provide proactive suggestions and help customers to manage their finances.

- Streamlining internal processes.

One of AI’s biggest advantages for banks is its ability to automate workflows. Long processes and timelines are common traits of the financial services industry. With the help of AI banks can cut down on the amount of time spent on administrative tasks and focus on innovating the customer experience.

AI can be used to generate documents, reports and audits, saving employees time and providing high-quality results.

- Personalised experiences.

AI and machine learning make it easier for banks to analyse and understand customer preferences and needs, enabling them to provide personalised suggestions, recommendations and offers.

Blog post updated July 2020