Digital Banking and PFM in South Africa

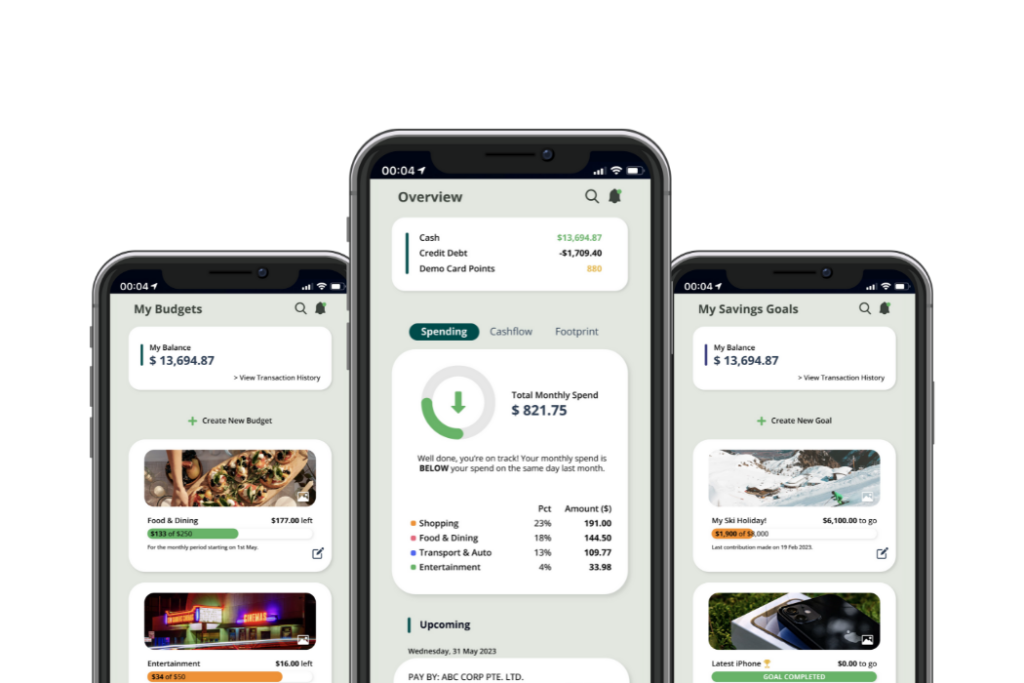

PFM stands for Personal Financial Management and refers to the digital tools that people use to manage their financial lives. The purpose of PFM solutions is to simplify money management and help people make better financial decisions.

At its most basic, PFM solutions provide simple money management tools such as transaction analysis and categorisation. However, advanced PFM solutions can offer much more and can include a full suite of personalised insights, recommendations and nudges to help their users improve their finances.

Consumers in South Africa are embracing and adopting digital solutions, causing a big shift in how financial services are used and accessed.

PFM solutions can play a crucial role in driving this digital shift as they provide tools which allow users to manage their finances effectively. This enables users to:

- Track expenses

- Create budgets

- Analyse spending habits

- Set financial goals

- Visualise financial data

- Get personalised financial tips and recommendations

By leveraging PFM solutions, financial institutions can increase digital adoption and financial inclusion. Read more about this in our whitepaper