Rapidly grow your customer base by implementing a range of Moneythor use cases such as unified multi-product referrals and social incentives to drive increased acquisition.

ONLY

23%

of financial institutions believe that their current acquisition strategies were successful.

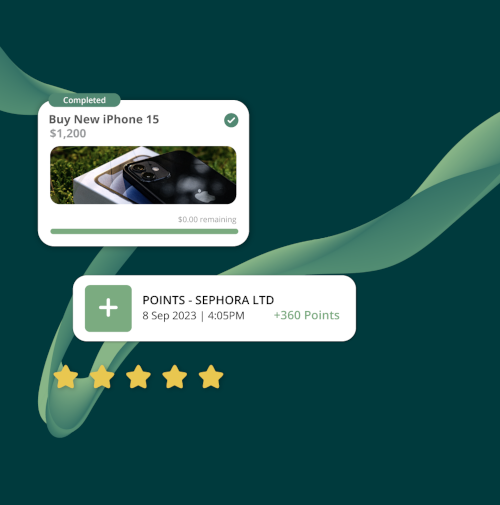

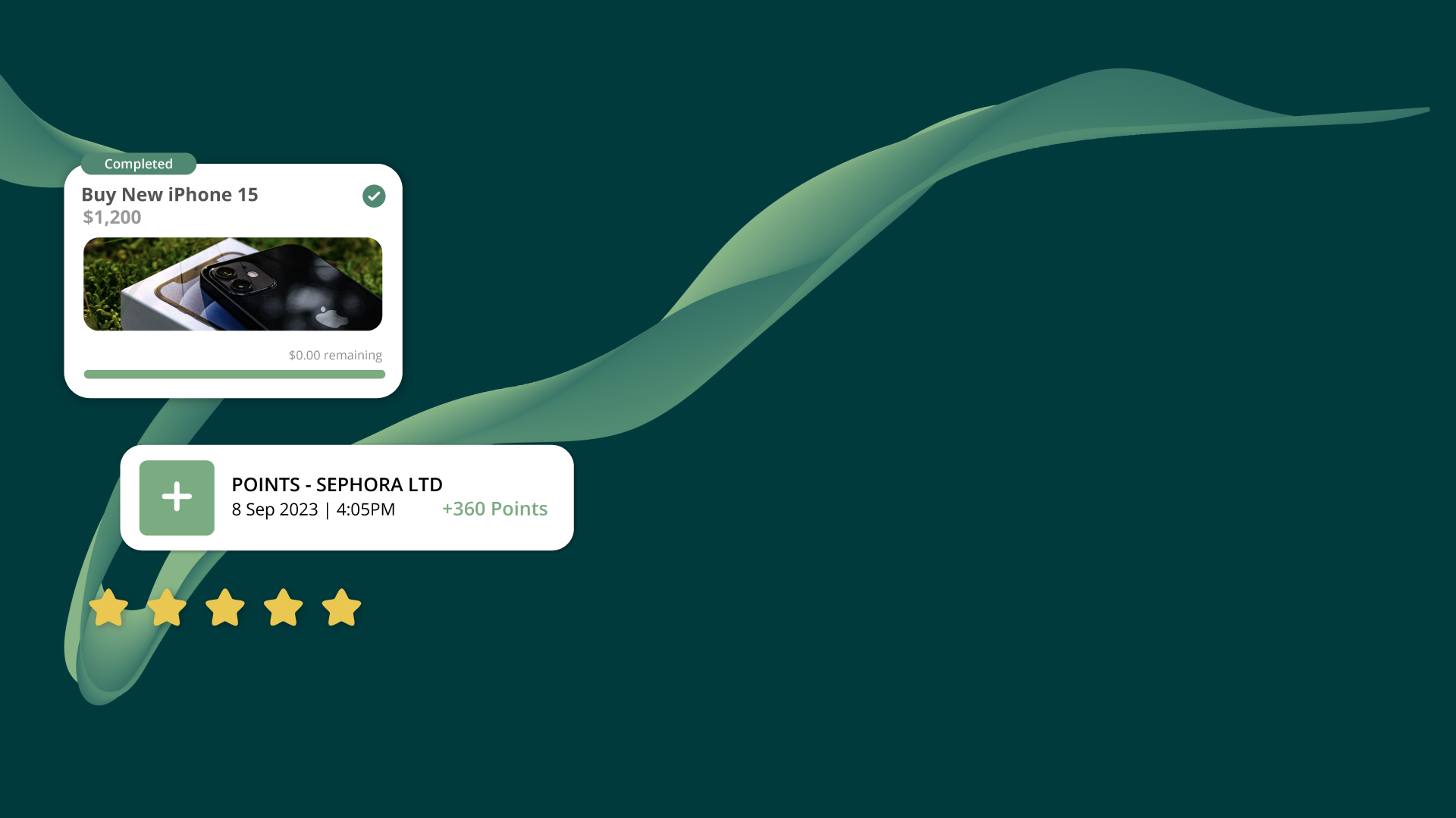

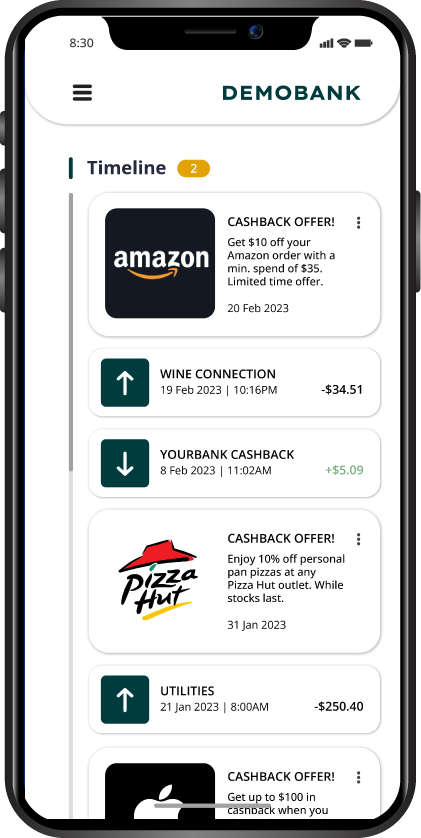

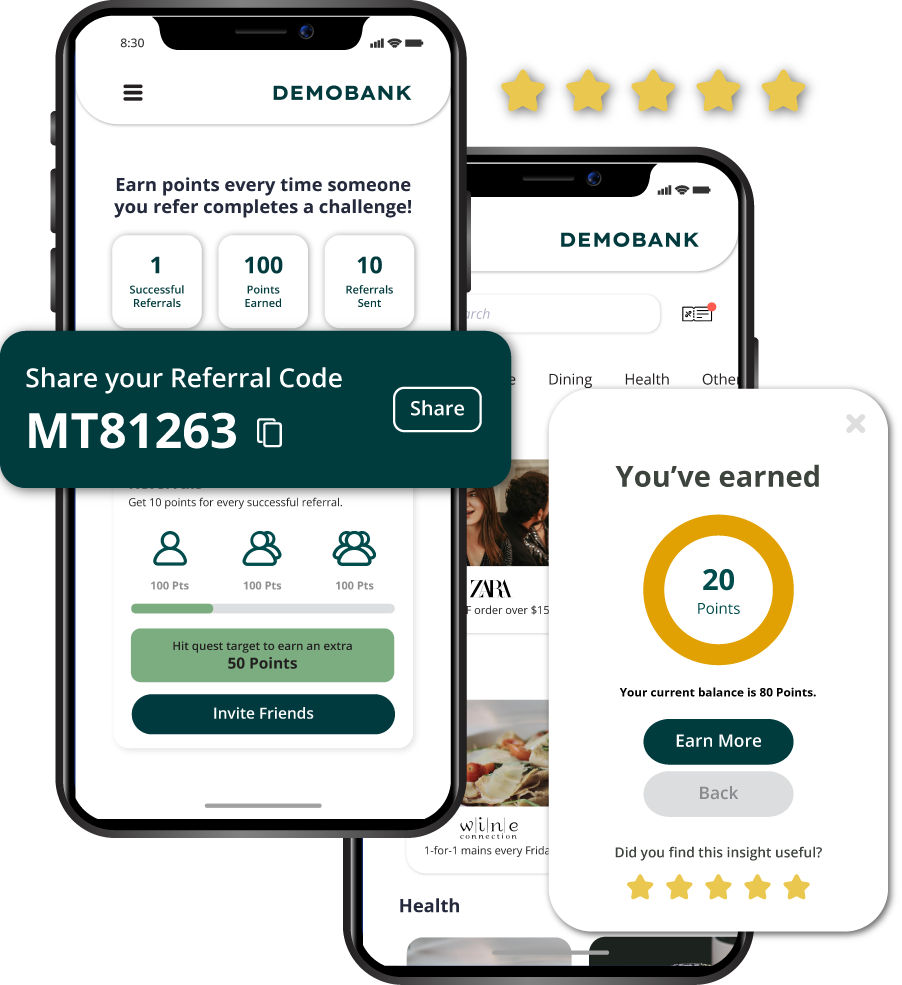

Referral Dashboard

A comprehensive view of referrals in action, along with any recent updates on activity. This includes tracking the progress of referrals, noting any successful conversions, and staying updated on the latest developments or changes in the referral program.

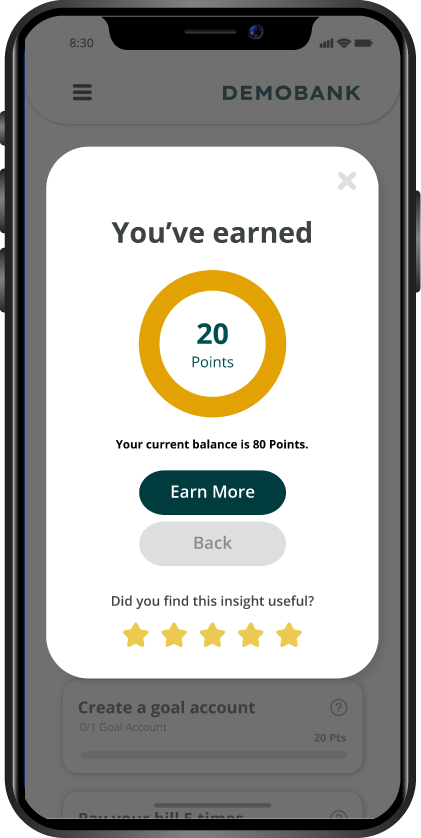

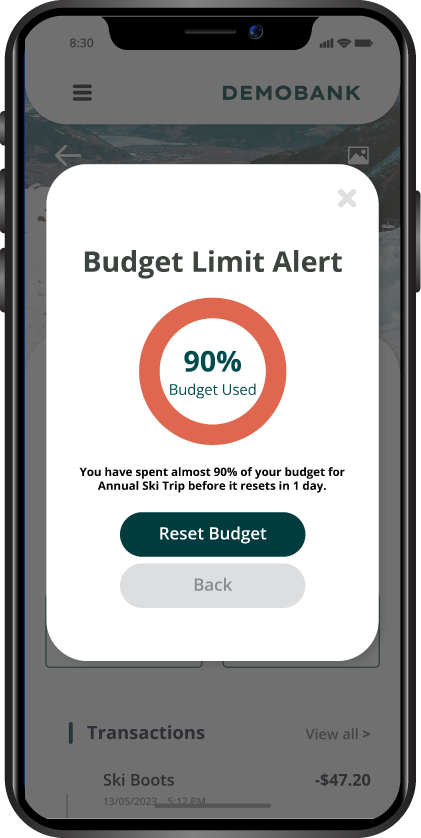

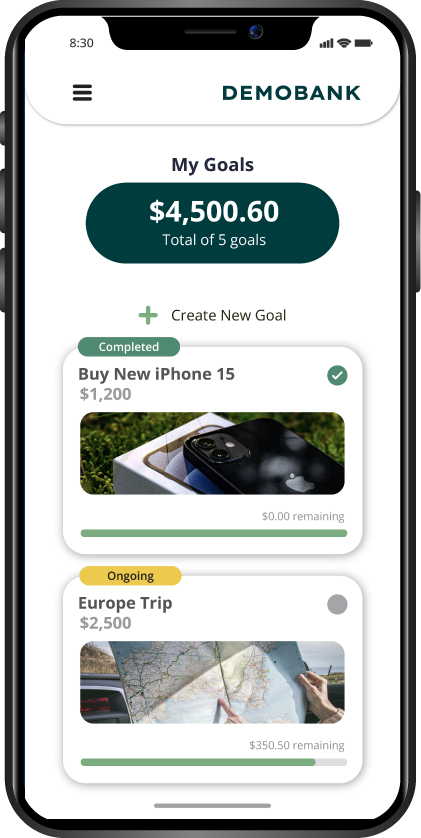

Progressive Incentives

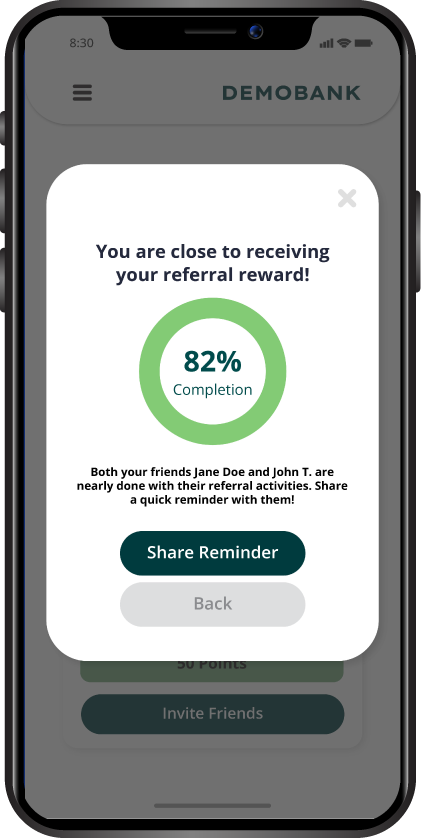

Implement behaviour-driven incentives that reward both the referee and referrer for completing various actions. These incentives can include bonuses, discounts, or other perks based on specific behaviours such as signing up, making purchases, or referring friends.

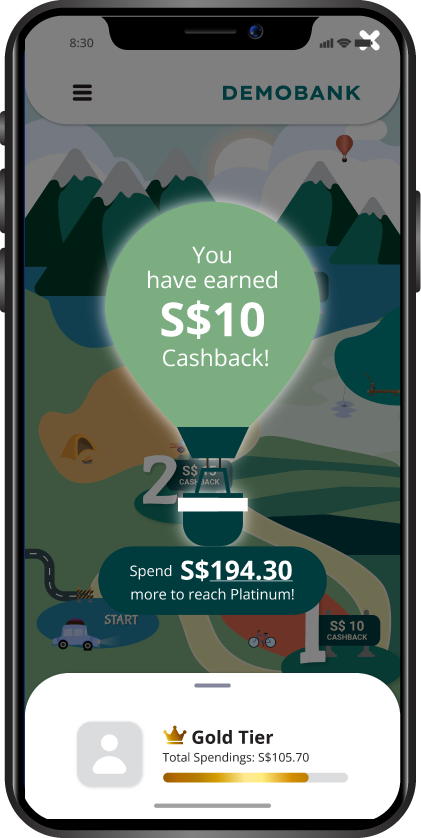

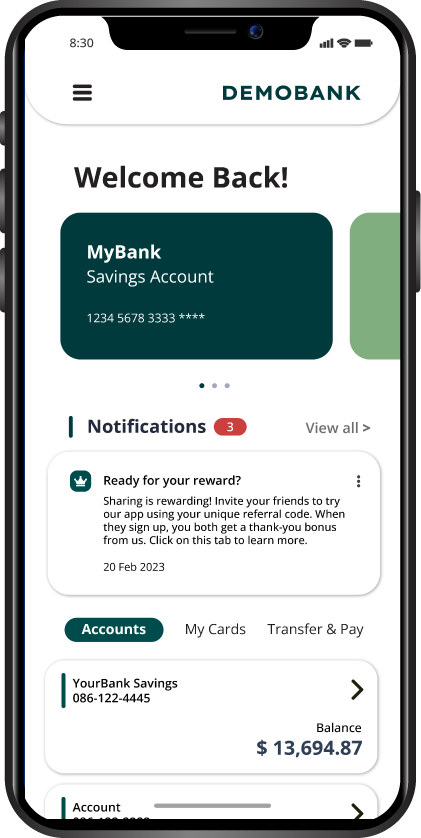

Real-time Nudges

Deliver nudges and reminders to keep both the referrer and referee engaged throughout their journey. These nudges can include personalised messages, progress updates, or prompts to take specific actions such as completing a referral, exploring new features, or redeeming rewards.