Chiba Bank, Japan’s largest regional financial institution, has partnered with Moneythor to deliver Deep Banking, creating digital experiences that are personalised, proactive, and genuinely engaging. The collaboration helps customers take control of their finances while building trust through daily, interactive interactions.

Since going live, Chiba Bank has implemented multiple money management use cases through the Chibagin App. Customers can participate in savings challenges, receive tailored insights, and get alerts based on their individual financial situations, making everyday banking smarter, simpler, and more relevant.

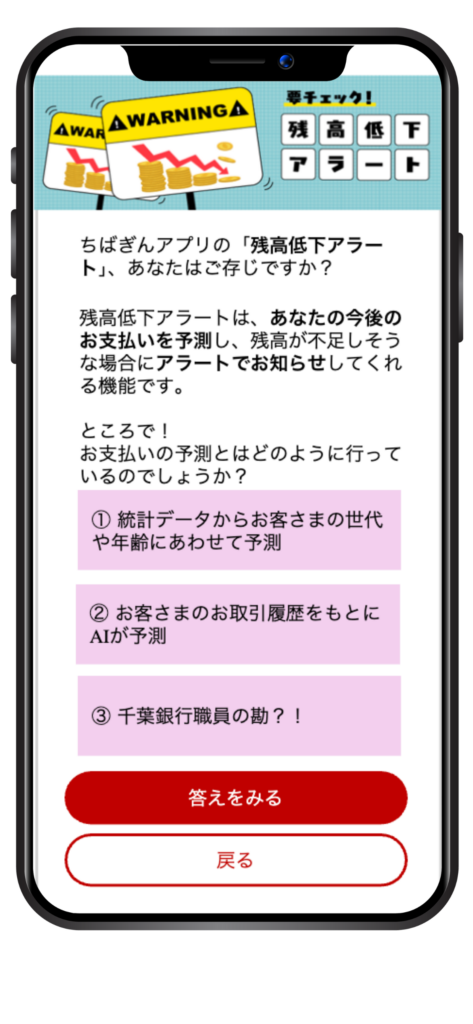

Beyond this, Chiba Bank has embraced gamification to turn banking into an interactive experience. Features like lotteries and challenges, drive increased engagement amongst users, while predictive cash flow forecasting and balance alerts empower users to make smarter financial decisions. Rewards have also been central to the Chibagin App campaigns, motivating users to take action and explore new features. For example, as part of their initiative to attract new customer sign-ups, Chiba delivered a rewarding and gamified experience that offered tangible incentives for registrations. This approach turned routine banking interactions into exciting, motivating experiences.

Cash flow alerts to keep customers on track with their finances

Quick bite questionnaire to keep customers engaged

Lottery game to drive increased activation

Key to Chiba Bank’s approach has been to create journeys that guide users seamlessly: from personalised recommendations, to detailed guidance, to completing sign-ups or participating in games. Each step is designed to educate, engage, and reward customers, keeping the experience intuitive and enjoyable.

Across all campaigns, Chiba Bank saw strong results. 79% of users who opened campaign messages completed the full engagement journey, while overall interactions and app engagement increased significantly. These metrics highlight the effectiveness of combining personalised insights, gamification, and rewards to drive meaningful customer participation.