Explore Our Products & Features

DOWNLOAD PRODUCT GUIDEACQUISITION

• Standard Referrals

• Tiered Referrals

• Agent & Staff Referrals

ACTIVATION

• Onboarding Challenges

• Real-time Vouchers, Gift Cards, Cashbacks and Points

• Gamified Experiences

ENGAGEMENT

• Recommendations, Insights & Nudges

• Spending Budgets and Subscription Tracking & Notifications

• Savings Goals & Automated Smart Contributions

• Forecasting

• Transaction Classification & Enrichment

• Family Banking

• Islamic Banking

• Carbon Footprint & ESG Insights

• Mass Affluent & Wealth Banking

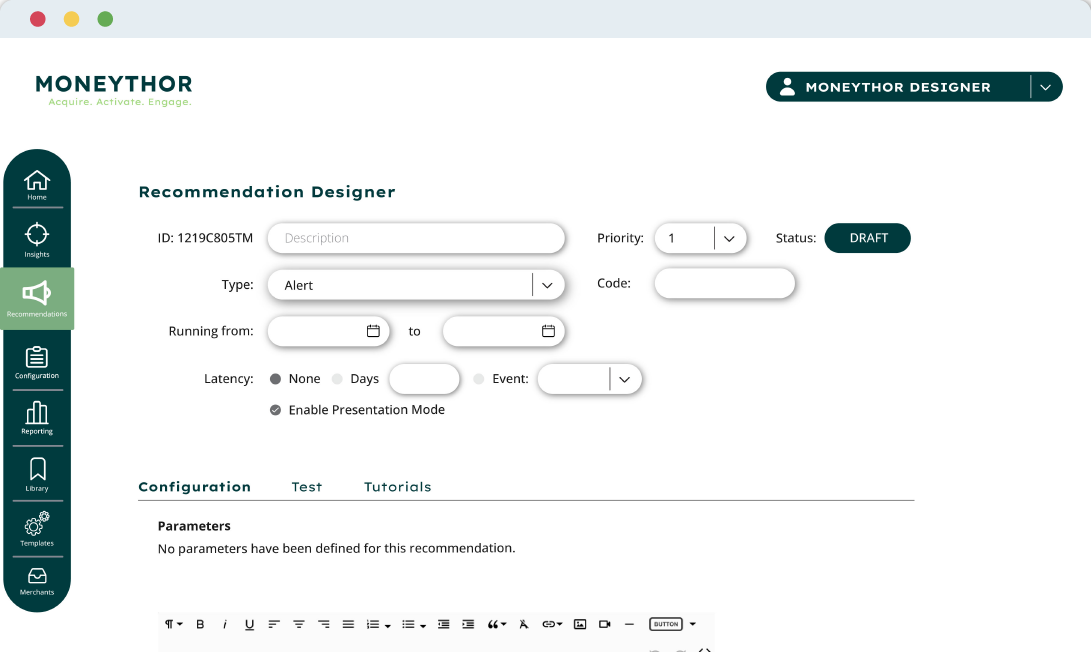

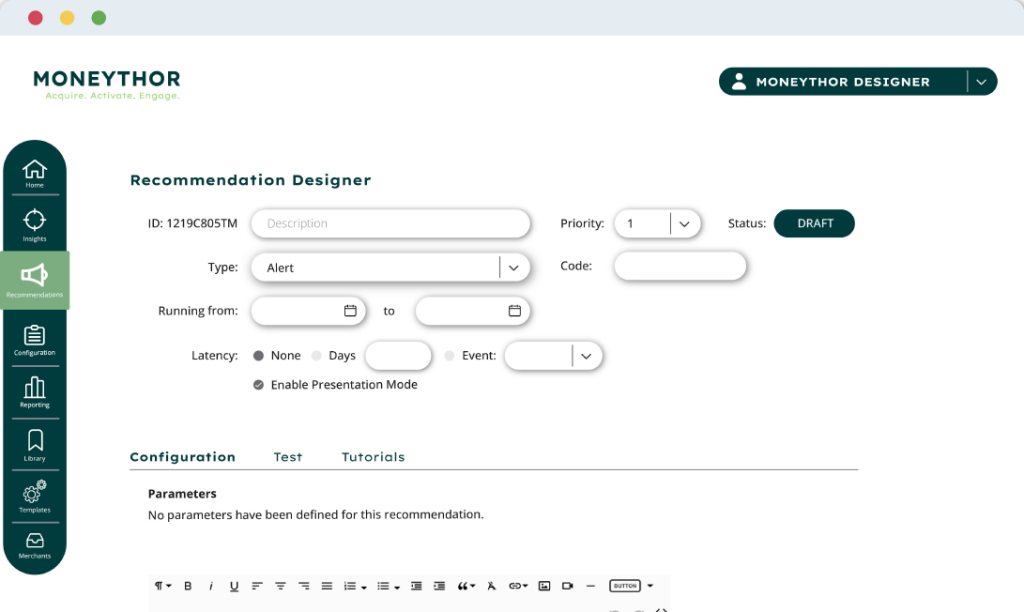

Build use cases to align with your goals with Moneythor Studio

Fully Configurable Solution

A flexible solution that powers financial institutions to adapt to evolving market trends, regulatory changes and customer preferences seamlessly.

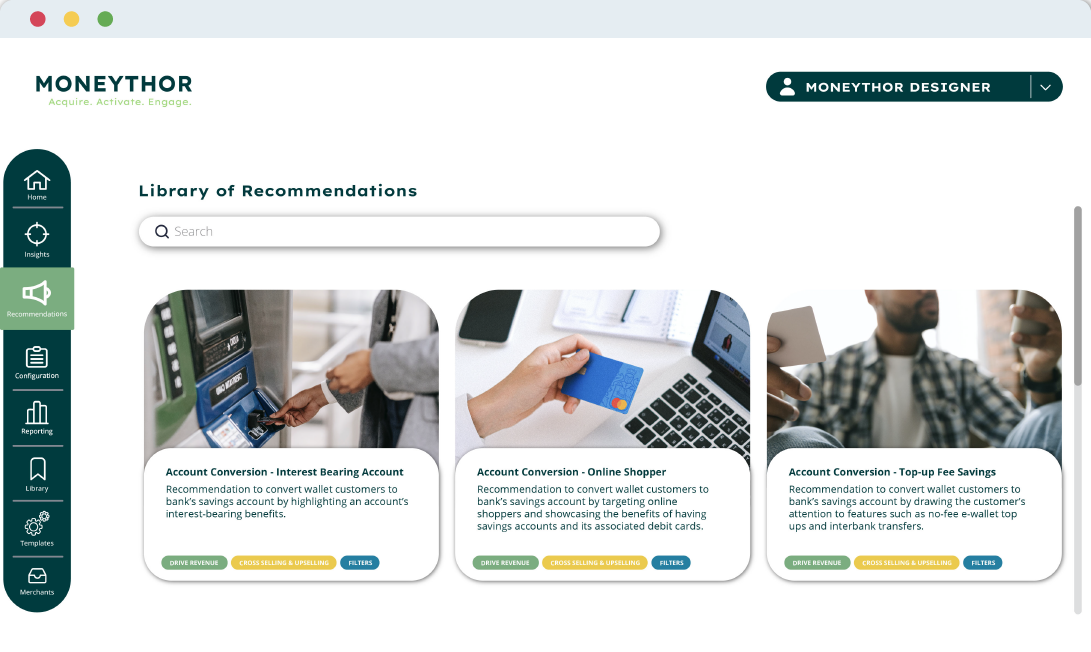

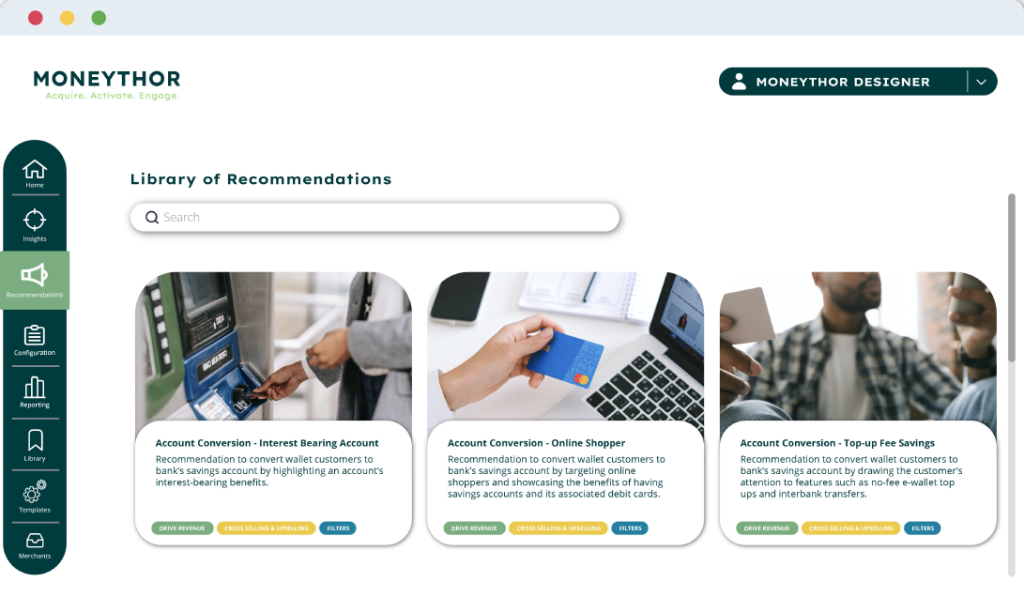

Library of

Pre-Built Use Cases

An extensive library of tailored use cases enables financial institutions to swiftly implement targeted use cases that resonate with individual customer needs.

Monetise Open Banking

Offer customers a comprehensive snapshot of their finances, regardless of where they bank. Open Banking can create a competitive edge for banks, enabling heightened engagement, personalised marketing, targeted cross-selling, and differentiation in the market.

Become the bank that streamlines customers’ experiences by eliminating the need for multiple logins. Provide a unified platform where customers can effortlessly review their entire financial status in one place.