Provide customers with a complete overview of their finances, regardless of where they bank

Bring customers to your digital channels by providing insights and recommendations based on data from multiple banks and fintechs.

LET'S GET STARTED

Bring customers to your digital channels by providing insights and recommendations based on data from multiple banks and fintechs.

LET'S GET STARTED1. Data from multiple sources is aggregated thanks to Open Banking.

2. The aggregated data is analysed and categorised by the Moneythor engine.

3. Recommendations, insights, and nudges are delivered to users based on transaction data from multiple sources.

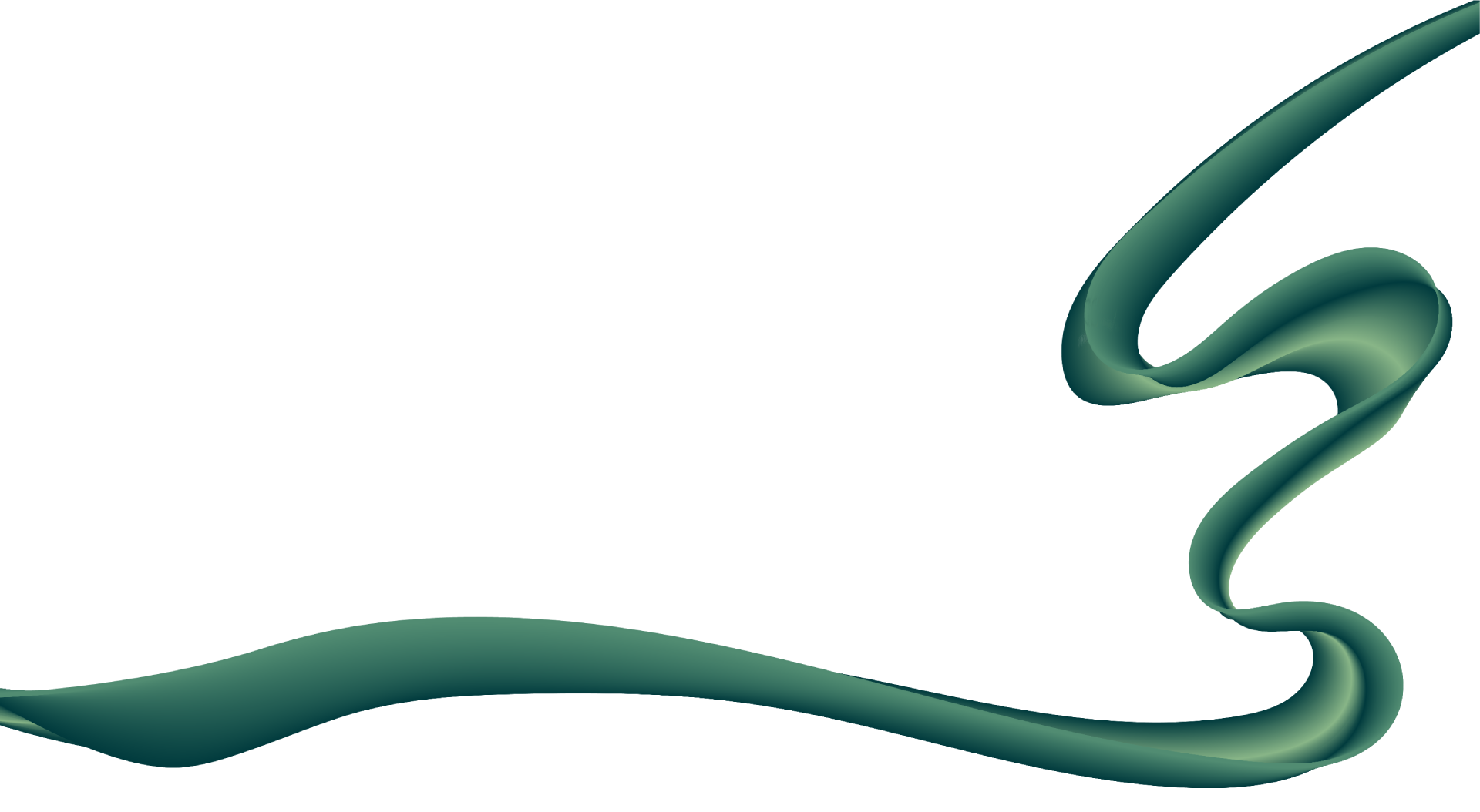

Provide a fully categorised view of aggregated transaction data from multiple accounts and banks in one place.

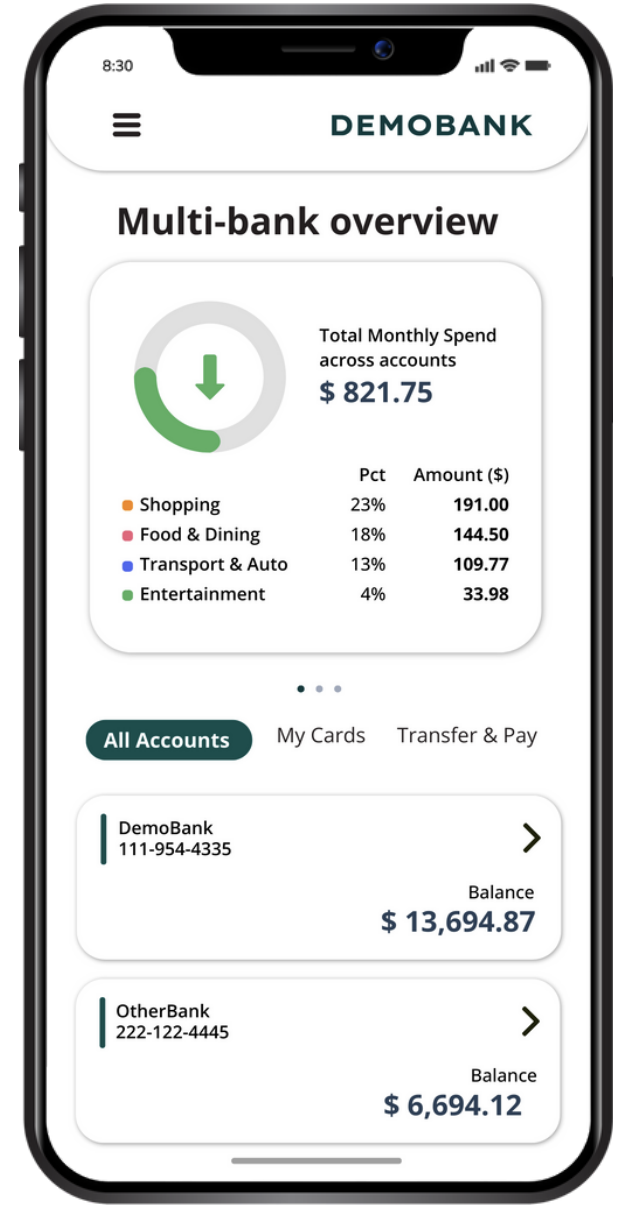

Deliver personalised alerts and insights to customers based on data from multiple banks.

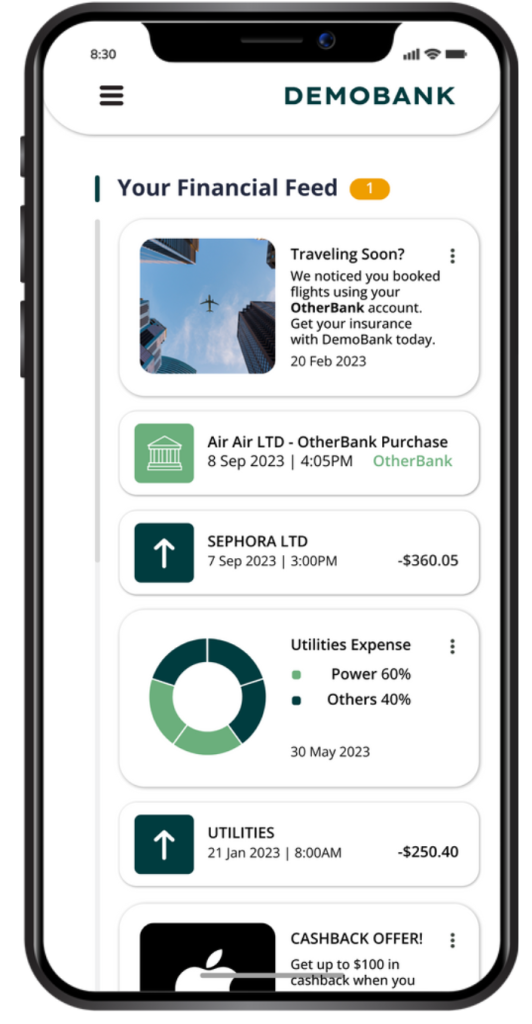

Multi-bank data allows banks to understand their customer’s needs and preferences and identify opportunities to cross-sell or upsell relevant products or services.

Open Banking can become an area of competitive advantage for banks. It can drive increased engagement, deliver hyper-personalised marketing and cross-sell messages, and set banks apart.

Be the bank that saves customers from multiple logins. Provide a one-stop shop for reviewing their current financial situation.

GET IN TOUCH

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields