Unlock Financial Inclusion in the Philippines with Deep Banking

Go beyond financial access – create meaningful customer relationships with personalised digital banking experiences.

Go beyond financial access – create meaningful customer relationships with personalised digital banking experiences.

44%

of Filipinos remain unbanked

Despite rapid economic growth and digital transformation, 44% of Filipinos remain unbanked. Traditional banking efforts have focused on basic access, but the real challenge lies in building trust, enhancing financial literacy, and ensuring accessibility. Financial institutions need to move beyond conventional approaches and embrace deep banking, a strategy designed to engage and empower customers for long-term financial wellbeing.

Deep banking is the key to transforming financial inclusion into sustainable engagement. By leveraging advanced technology and customer insights, financial institutions can:

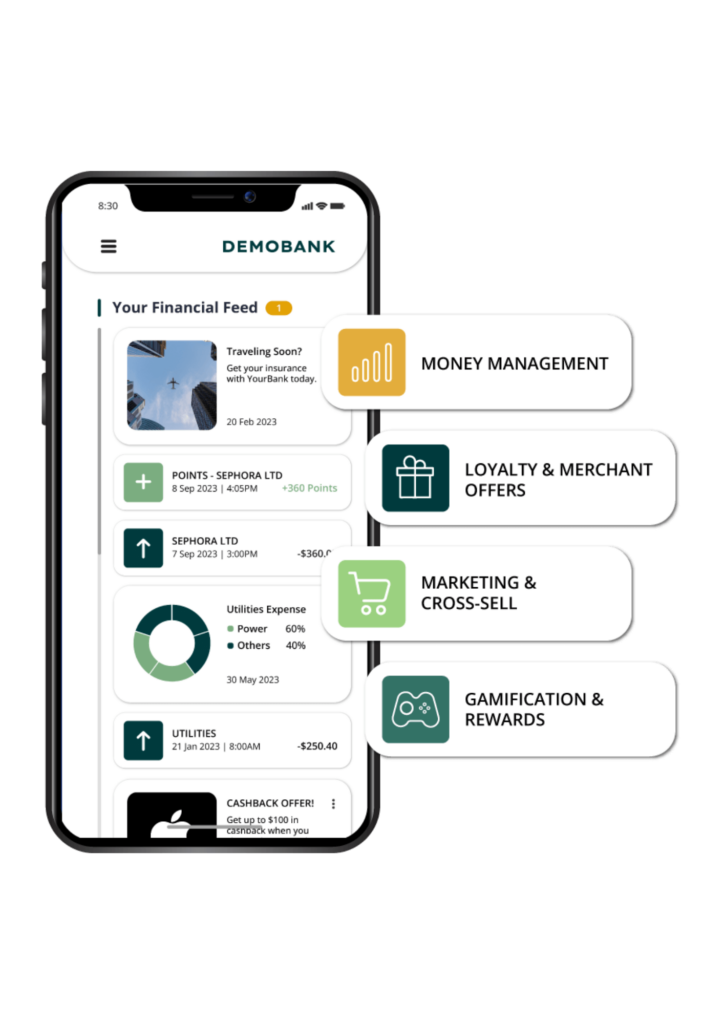

Deliver personalised financial insights that help customers manage their money more effectively.

Use gamification and smart nudges to increase financial literacy and encourage positive financial behaviour.

Enable seamless, data-driven engagement that builds trust and fosters long-term customer relationships.

Since its launch in September 2022, Trust Bank has rapidly grown to capture over 12% of the market, establishing itself as one of the world’s fastest-growing digital banks. Competing in Singapore’s highly competitive market, Trust Bank sought a solution that could deliver a seamless, personalised, and innovative banking experience to drive customer acquisition and engagement.

With Moneythor’s support, Trust Bank introduced real-time reward redemption and a groundbreaking referral programme, achieving a lower-than-average cost of acquisition. By offering instant FairPrice E-vouchers for successful referrals, nearly 70% of new customers joined through recommendations from friends or family.

Since its inception, Trust Bank has welcomed 700,000 new customers, with 85% activating their cards and conducting an average of 17 transactions per month. Digital coupon redemptions exceeded 2.2 million, and the bank’s app boasts a 4.8 rating on the Apple App Store, reflecting its commitment to delivering exceptional customer experiences.

Read more about how Moneythor and Trust Bank are working together.

While financial institutions in the Philippines have made strides in expanding financial access, the next challenge lies in sustained customer engagement. With 44% of Filipinos still unbanked, traditional financial services need to evolve to meet the expectations of digitally savvy consumers and underserved communities.

The next generation of banking must move beyond basic inclusion. It must be deeply personalised, interactive, and insight-driven, offering solutions that build trust, financial literacy, and long-term engagement.

Download the Free Guidebook to discover how Deep Banking can help financial institutions in the Philippines bridge the gap between access and engagement, driving lasting financial empowerment.

Traditional financial services often fail to connect with the 44% of Filipinos who remain unbanked. Through AI-driven personalisation, financial institutions can deliver tailored insights and smart nudges, helping individuals gain confidence in managing their money.

Lack of trust and financial literacy are major barriers to banking adoption. Interactive challenges and rewards encourage unbanked individuals to engage with financial services in a way that feels familiar, engaging, and rewarding.

Financial inclusion isn’t just about opening an account—it’s about sustained engagement. Customised loyalty programmes, including points-based rewards and merchant offers, incentivise long-term usage, helping customers integrate banking into their daily lives.

Reward customers for their actions with games and interactive challenges.

Acquire, activate and engage customers with referral management, loyalty campaigns, gamified experiences and real-time money management.

Easily and quickly deploy the moneythor solution

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields

"*" indicates required fields