The Moneythor Engine

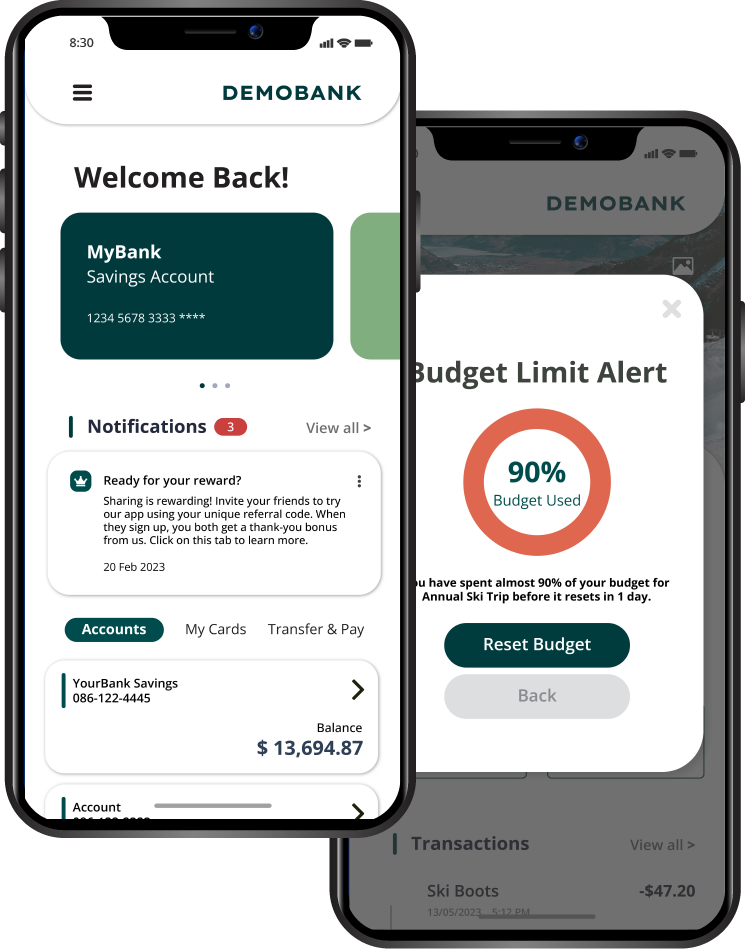

At the core of the Moneythor solution is a high-performance scalable event-processing and orchestration engine processing real-time and batch data from any assets and liabilities, such as accounts, cards, digital wallets, and Open Banking sources.

The engine enables AI-driven enrichment of data and the execution of customised customer experiences across online banking, mobile apps, chatbots, and internal CRM tools. This ensures that customers enjoy engaging tailored experiences, regardless of the channel they choose to interact with.

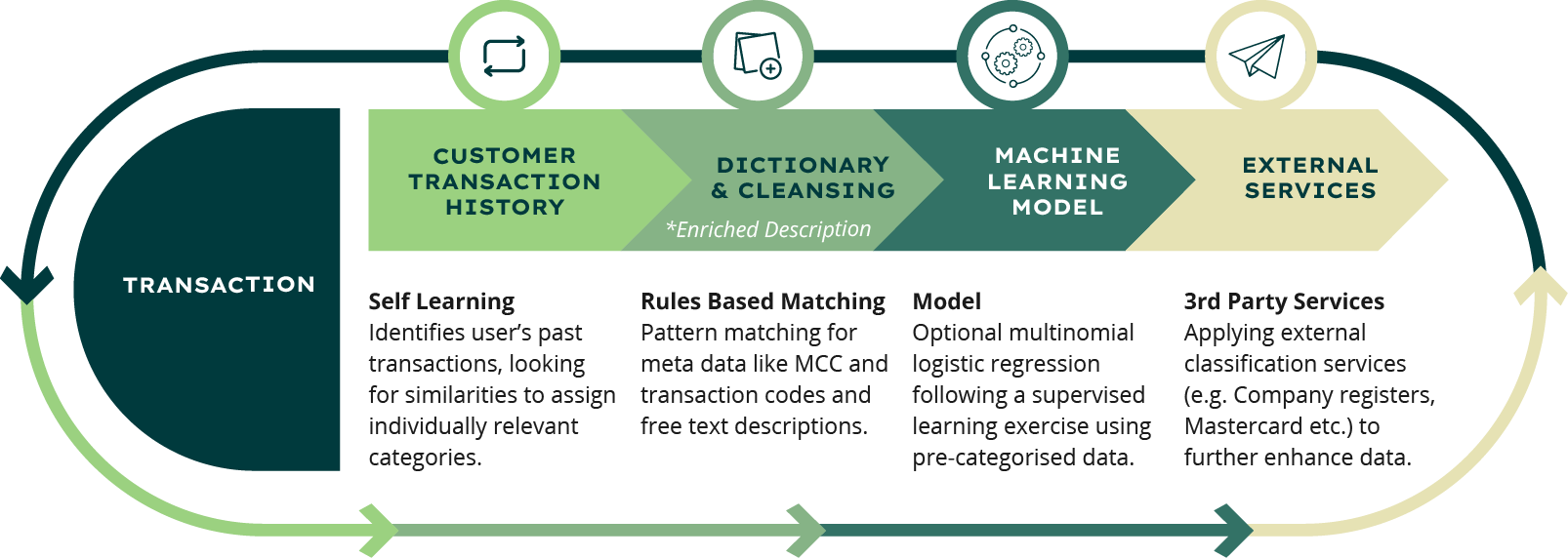

Categorisation Steps

To provide richer actionable data points to generate more intelligent money management & loyalty features and personalised insights, the Moneythor engine performs transaction categorisation & enrichment across all types of accounts, cards and e-wallets.

The categorisation process uses several methods including text analysis, multivariate rules based on regular expressions and priority levels, machine learning, external services where applicable. Additionally, the engine learns from individual customer preferences over time, refining its categorisation approach as usage grows.

The Moneythor Engine

LET’S GET STARTEDAI POWERED DATA

ENRICHMENT

By harnessing the capabilities of artificial intelligence, the Moneythor engine can seamlessly analyse and enrich customer data, gaining insights into individual preferences, behaviours, and financial patterns.

SEAMLESS INTEGRATION ACROSS MULTIPLE CHANNELS

Moneythor offers a channelagnostic solution, seamlessly integrating across various frontend channels such as banking apps, online banking portals, chatbots, ATMs, and more.

DEPLOY WHERE

YOU NEED

Deploy within your existing technical infrastructure, on your preferred cloud-based platform or implement Moneythor’s SaaS solution.

Moneythor SaaS Solution

Moneythor offers a fully SaaS model of implementation reducing upfront costs and limiting infrastructure adjustments. Moneythor holds certifications for ISO 27001 and SOC2 Type 2, ensuring robust security standards. Schedule a demo now to explore further details about our SaaS solution.