Banque numérique et GFP en Afrique du Sud

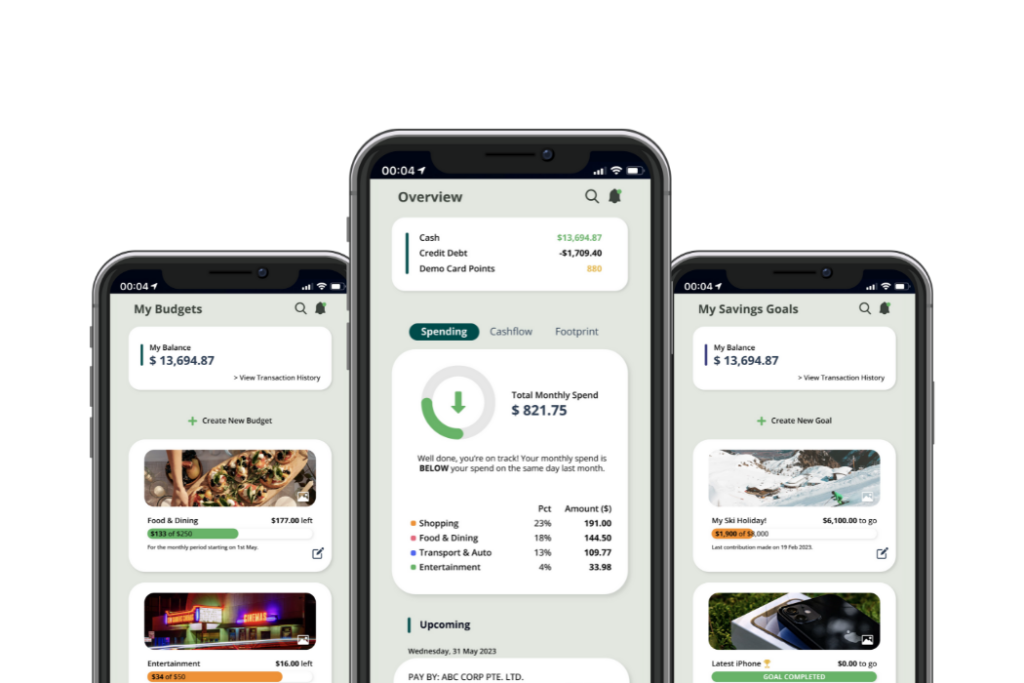

PFM signifie Personal Financial Management et fait référence à outils numériques que les gens utilisent pour gérer leur vie financière. L’objectif des solutions PFM est de simplifier la gestion financière et d’aider les gens à prendre de meilleures décisions financières.

À la base, les solutions PFM fournissent des outils simples de gestion financière tels que l’analyse et la catégorisation des transactions. Cependant, les solutions avancées de GFP peuvent offrir bien plus et inclure une suite complète d’informations, de recommandations et de coups de pouce personnalisés pour aider leurs utilisateurs à améliorer leurs finances.

Les consommateurs sud-africains adoptent et adoptent des solutions numériques, ce qui entraîne un changement majeur dans la manière dont les services financiers sont utilisés et accessibles.

Les solutions de GFP peuvent jouer un rôle crucial dans la conduite de ce virage numérique, car elles fournissent des outils permettant aux utilisateurs de gérer efficacement leurs finances. Cela permet aux utilisateurs de :

- Suivre les dépenses

- Créer des budgets

- Analyser les habitudes de dépenses

- Fixer des objectifs financiers

- Visualisez les données financières

- Obtenez des conseils et des recommandations financières personnalisés

En tirant parti des solutions PFM, les institutions financières peuvent accroître l’adoption du numérique et l’inclusion financière. En savoir plus à ce sujet dans notre livre blanc