使用事例

顧客の経済的幸福を向上させる

消費者に鋭い金融リテラシーと財務状況の適切な理解を提供するために、銀行は消費者が短期および長期の財務目標を達成するための適切なツールを確実に利用できるようにすることにますます重点を置き、デジタル バンキング サービスの機能を強化中です。

使用事例

消費者に鋭い金融リテラシーと財務状況の適切な理解を提供するために、銀行は消費者が短期および長期の財務目標を達成するための適切なツールを確実に利用できるようにすることにますます重点を置き、デジタル バンキング サービスの機能を強化中です。

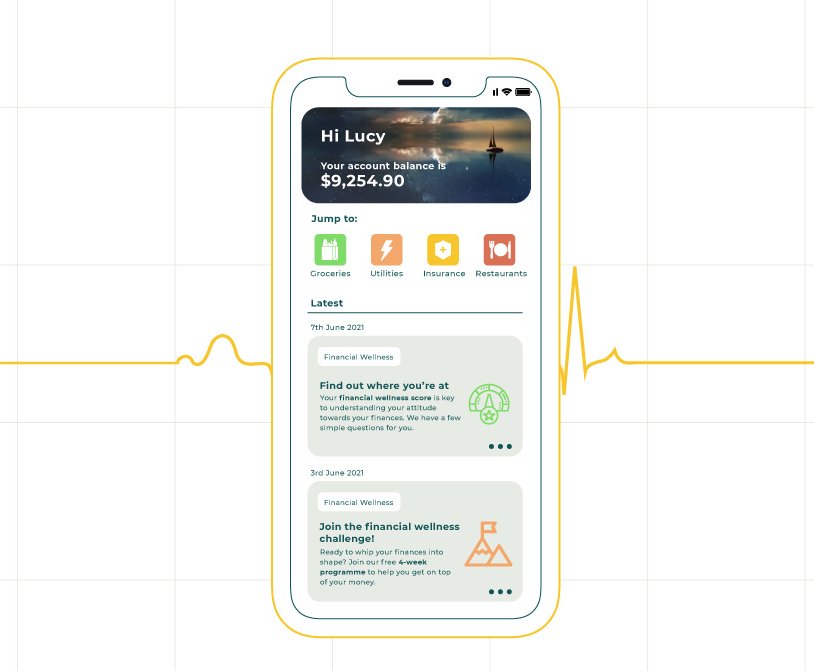

Moneythor ソリューションは、インタラクティブな金融福祉プログラムの導入をすぐにサポートする、構成可能なユースケースを提供します。

あらゆる規模の金融機関は、長期的に顧客の経済的幸福を向上させるように設計されたパーソナライズされた洞察、実用的な推奨事項、状況に応じたナッジにより、提供するデジタル エクスペリエンスをアップグレードできます。

良い金銭習慣の採用を奨励する

透明性の高いヒントやカスタマイズされたアクティビティを通じて顧客に財務状況をより詳しく把握してもらうことで、デジタル バンクを真の日常的な財務ガイドとして位置付けることができます。Moneythor プラットフォームとそのオーケストレーション エンジンにより、銀行アプリ内にこのようなパーソナライズされた財務コーチを導入できます。

チャレンジと報酬でエンゲージメントを促進

財務上の幸福プログラムも、楽しく魅力的なものにすることができます。このソリューションでは、達成すべき目標とマイルストーンを設定した長期にわたるチャレンジを設定できます。また、財務状況の改善に向けて進んでいる顧客には、プラットフォームから報酬を与えることもできます。

顧客のデータを充実させて、お金の使い道に関する顧客の理解を深めます。顧客がより健全な財務生活を送れるよう、デジタル ツールとパーソナライズされたアドバイスを設定します。オンライン バンキング サービスとモバイル バンキング サービスを支える既存のインフラストラクチャ内に、独自の財務コーチを導入します。

人々が経済的に健全になるよう支援することは、Moneythor にとって非常に大切なことです。ここでは、経済的な健全性とデジタル バンキングの相乗効果をより深く理解するための記事、ガイド、すべきこと、すべきでないこと、専門家へのインタビューのシリーズをご紹介します。

「*」は必須フィールドを示します

「*」は必須フィールドを示します

「*」は必須フィールドを示します

「*」は必須フィールドを示します

「*」は必須フィールドを示します

「*」は必須フィールドを示します

「*」は必須フィールドを示します

「*」は必須フィールドを示します